Company

NMLS

#411500

Company Phone

(877) 788-3520

Address

2907 Butterfield Rd Ste 200

Oak Brook, IL 60523

About

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Aliquet enim tortor at auctor urna nunc id cursus metus. Aenean sed adipiscing diam donec adipiscing tristique risus nec feugiat. Nisi porta lorem mollis aliquam ut porttitor leo a diam. Venenatis tellus in metus vulputate eu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Aliquet enim tortor at auctor urna nunc id cursus metus. Aenean sed adipiscing diam donec adipiscing tristique risus nec feugiat. Nisi porta lorem mollis aliquam ut porttitor leo a diam. Venenatis tellus in metus vulputate eu.

The Federal Savings Bank is an Equal Housing Lender.

LEARN Your Way Home with Joseph Prettner

Get to know your mortgage professional, browse popular content and gain knowledge that will lead you to qualify for the best possible mortgage rates and terms available!

Trending Topics

Browse All

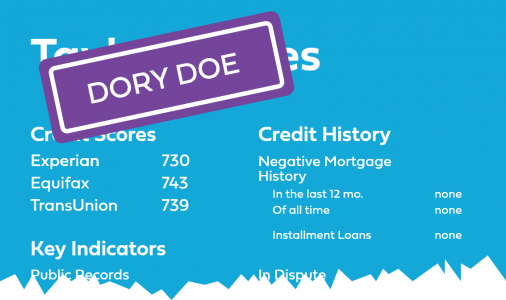

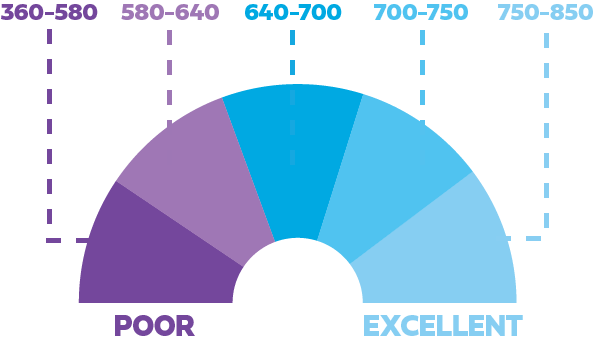

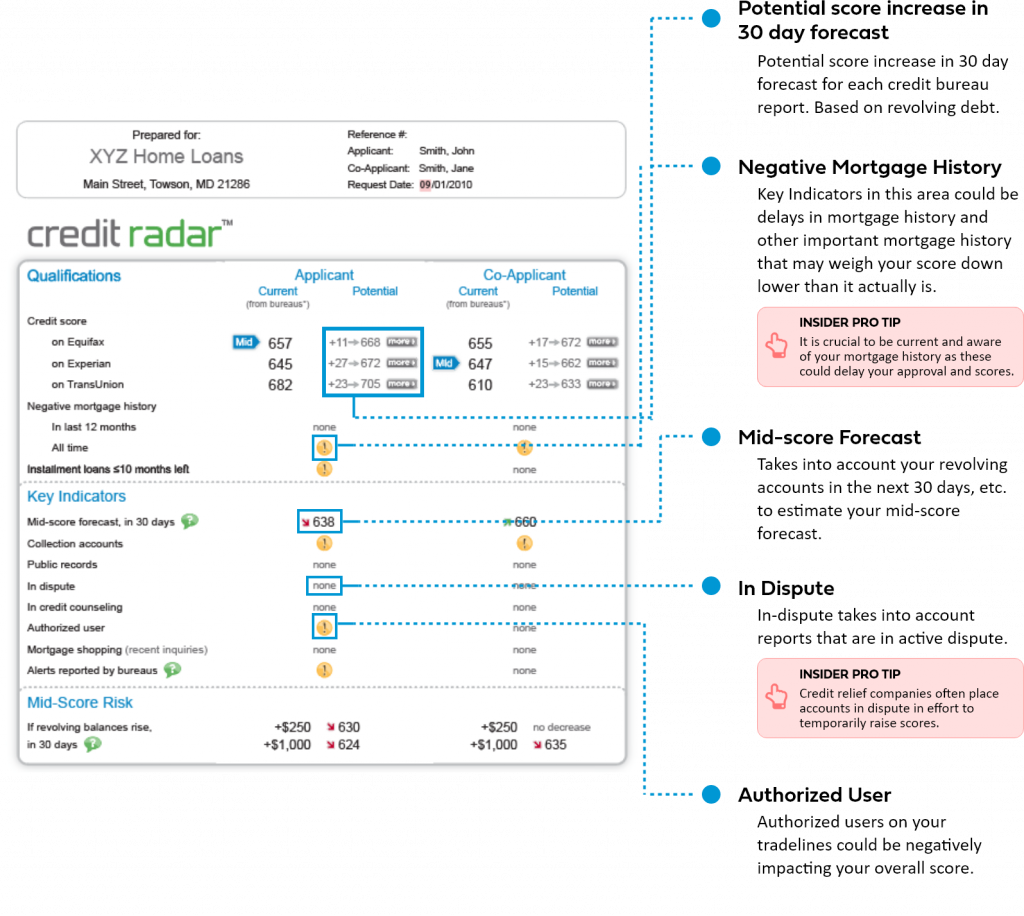

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

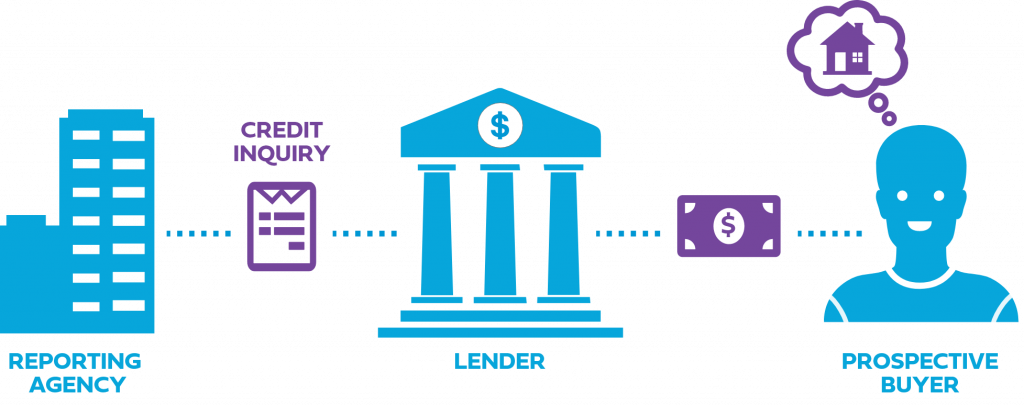

What Is an Inquiry?

What Is a Tradeline?

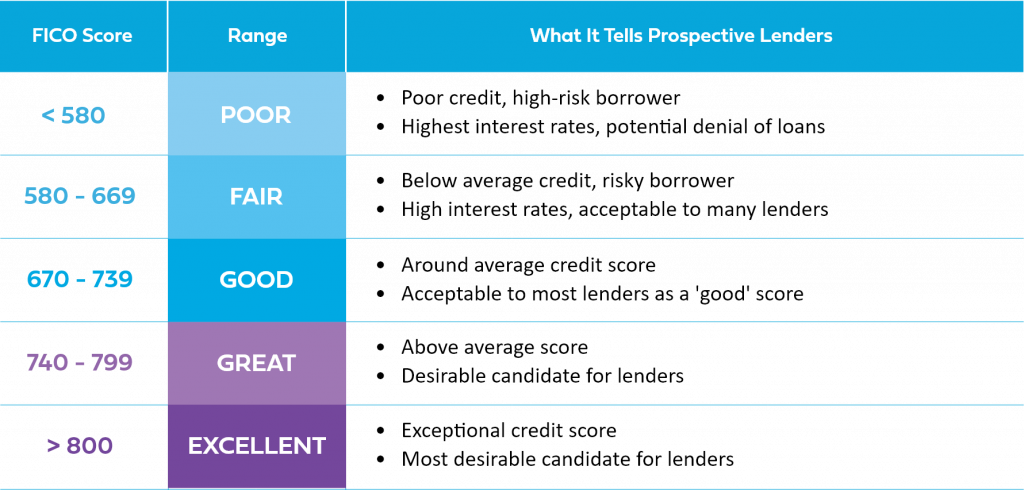

What Is a FICO® Score?

Do Other Scoring Models Exist?

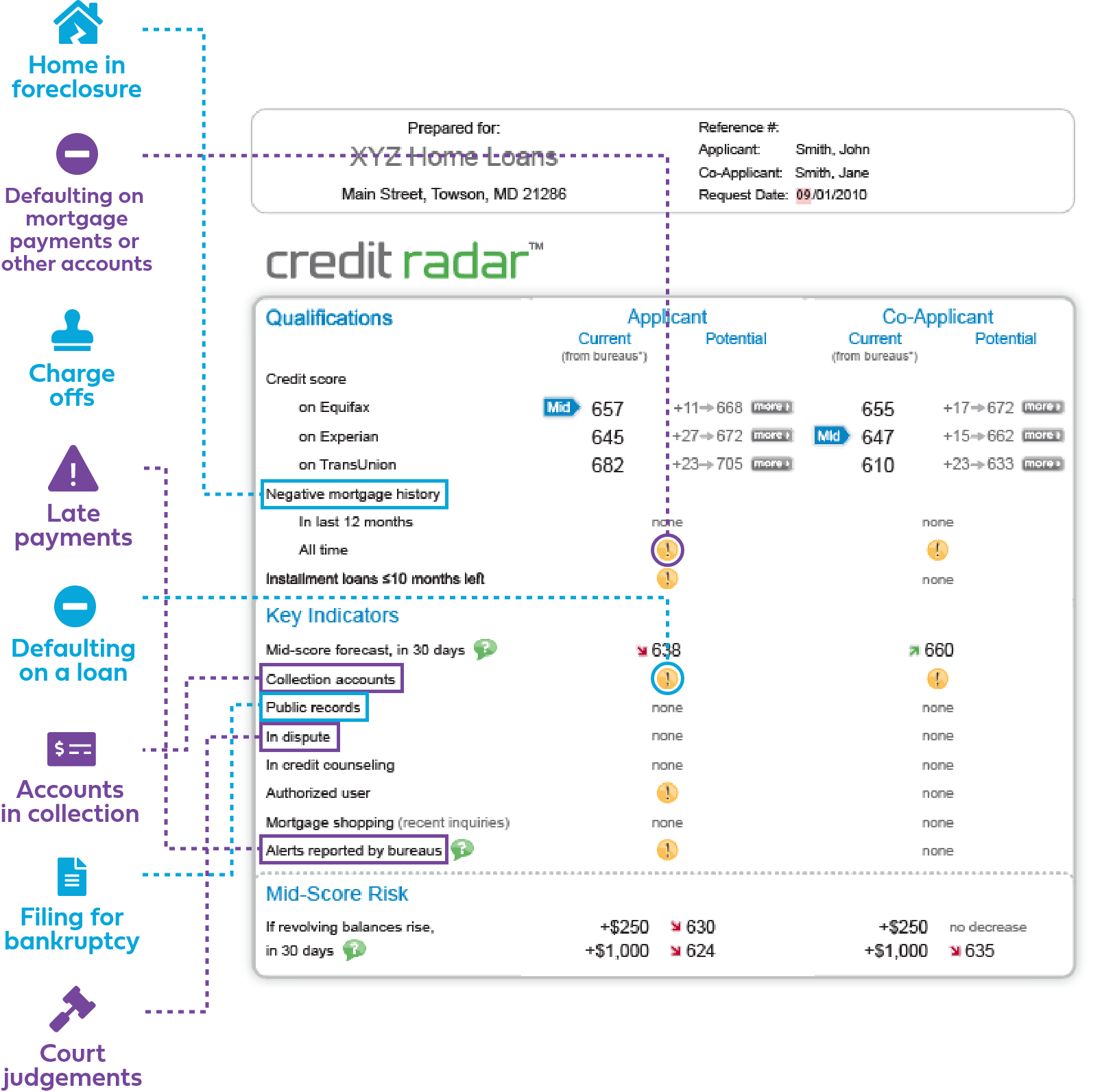

Can My Credit Score Be Improved?

Common Reasons Why Your FICO® Score Is Low

Learned all of

Score & Credit Basics?

Test your Credit IQ with our short, 8 question quiz.

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

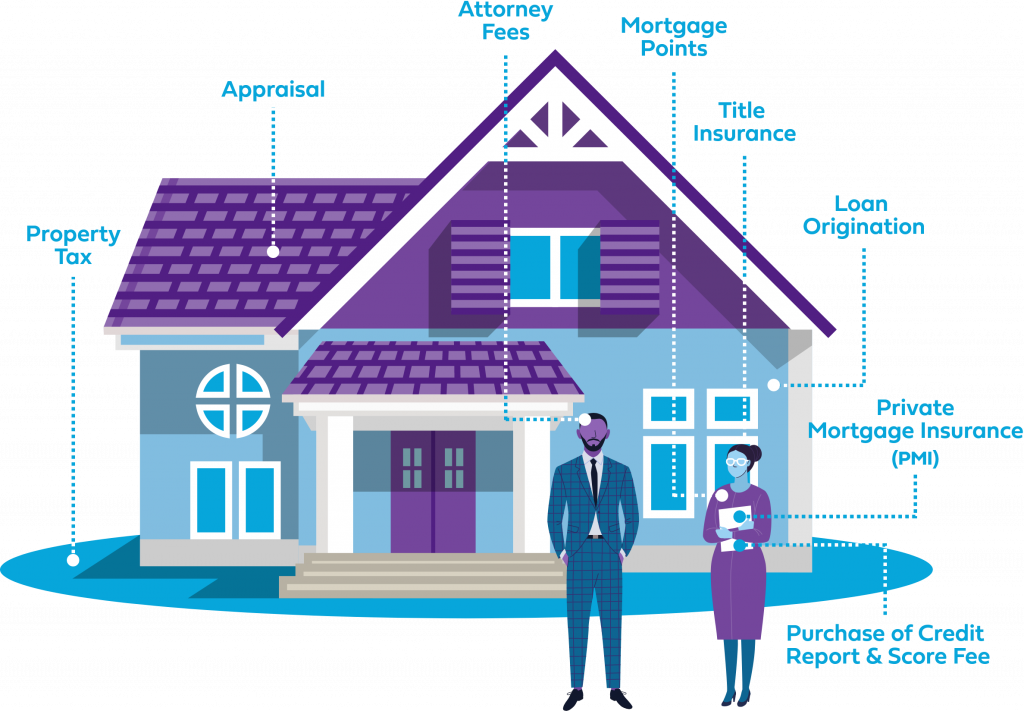

How Much Should I Save for a Down Payment & Closing...

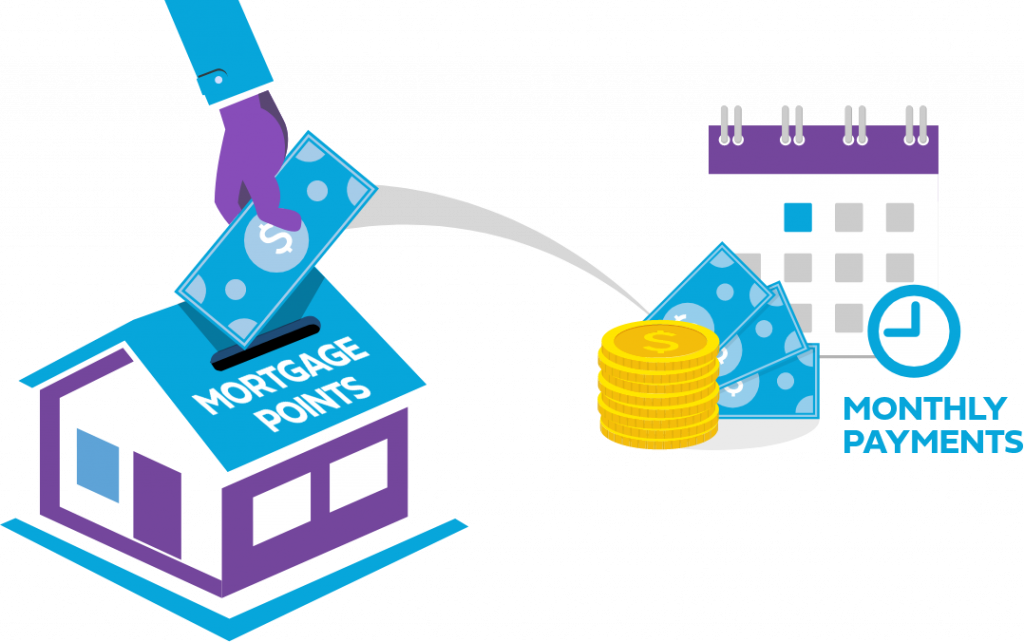

What Are Mortgage Points?

What Costs Are Included in My Mortgage Payment?

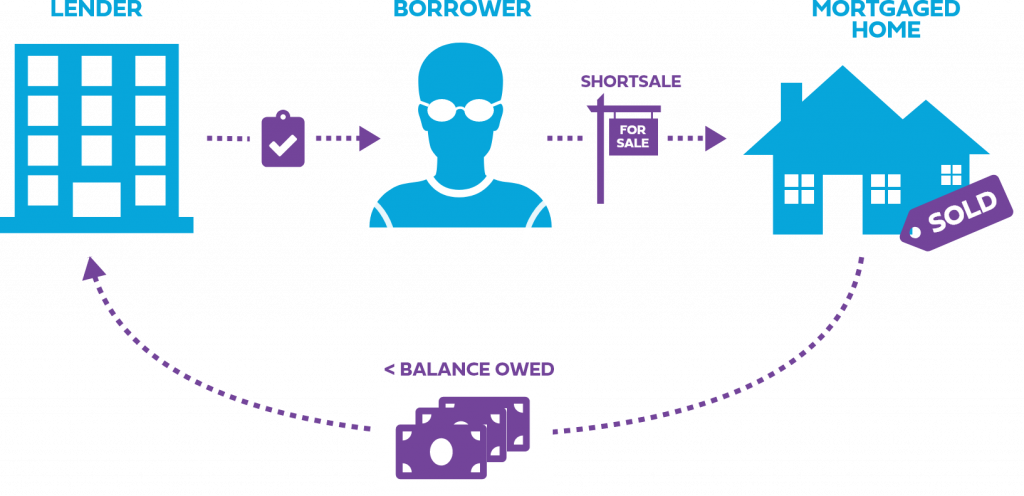

Foreclosures vs. Shortsales

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Learned all of

Mortgage Essentials?

Test your Credit IQ with our short, 9 question quiz.

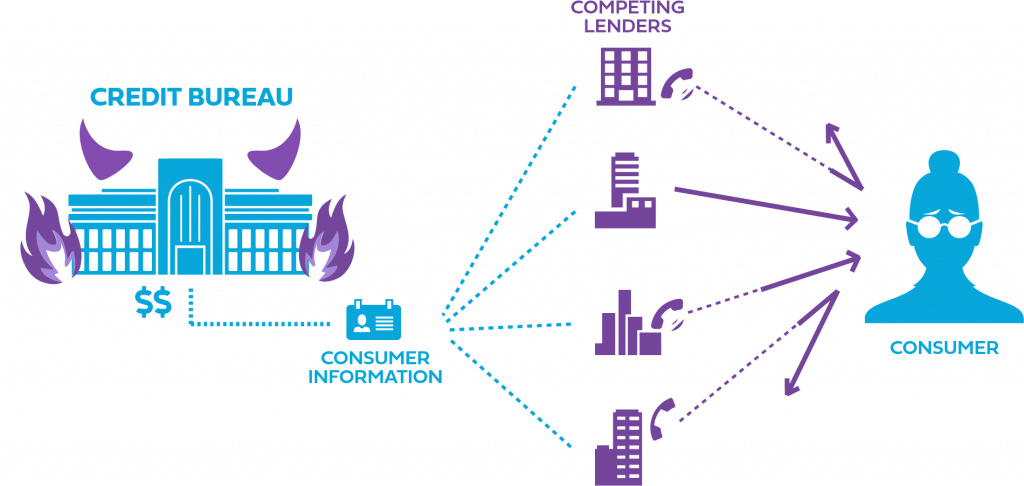

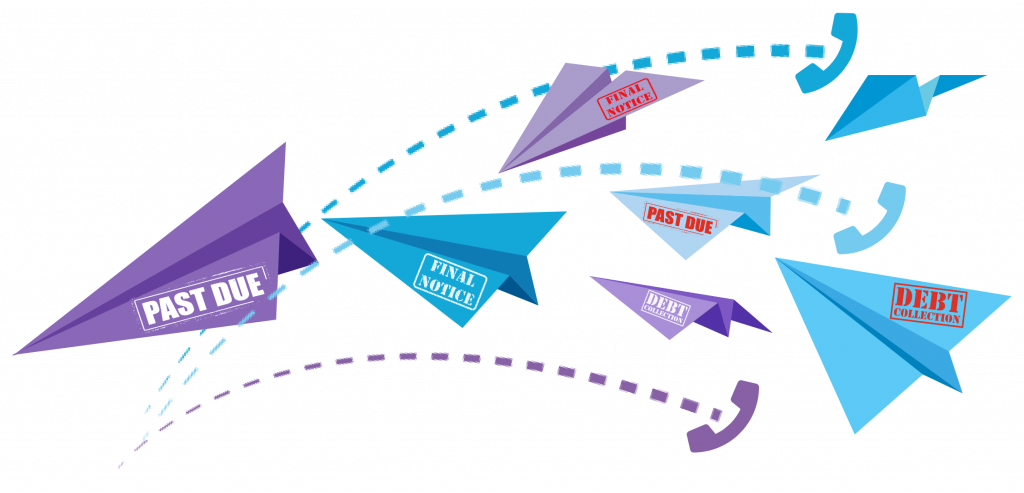

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Don't worry, they're all 10 questions or less and you'll receive instant results with the ability to try as many times as you'd like.

Score & Credit Basics

0%

Mortgage Essentials

0%

Buyer Alert

0%

Thank you for choosing...

Joseph Prettner

and

The Federal Savings Bank

Table of Contents

Credit Technologies Inc.®, the power behind BestQualify, has over thirty years of experience enabling home buyers like you to qualify for the best possible mortgage rates and terms available. We have the technology and the tools you need to get your score to the next level.