Common New Home Buyer Mortgage Fails

Mortgage Fails Happen.

Mistakes happen to the best of us, but if you know what to look out for, your journey to home ownership will be much smoother. The pros behind BestQualify have identified common missteps that first-time home buyers often make. Some are more obvious than others, but knowing what they are and how to circumvent them will definitely give you peace of mind.

INSIDER PRO TIPS

Common Fails to Avoid

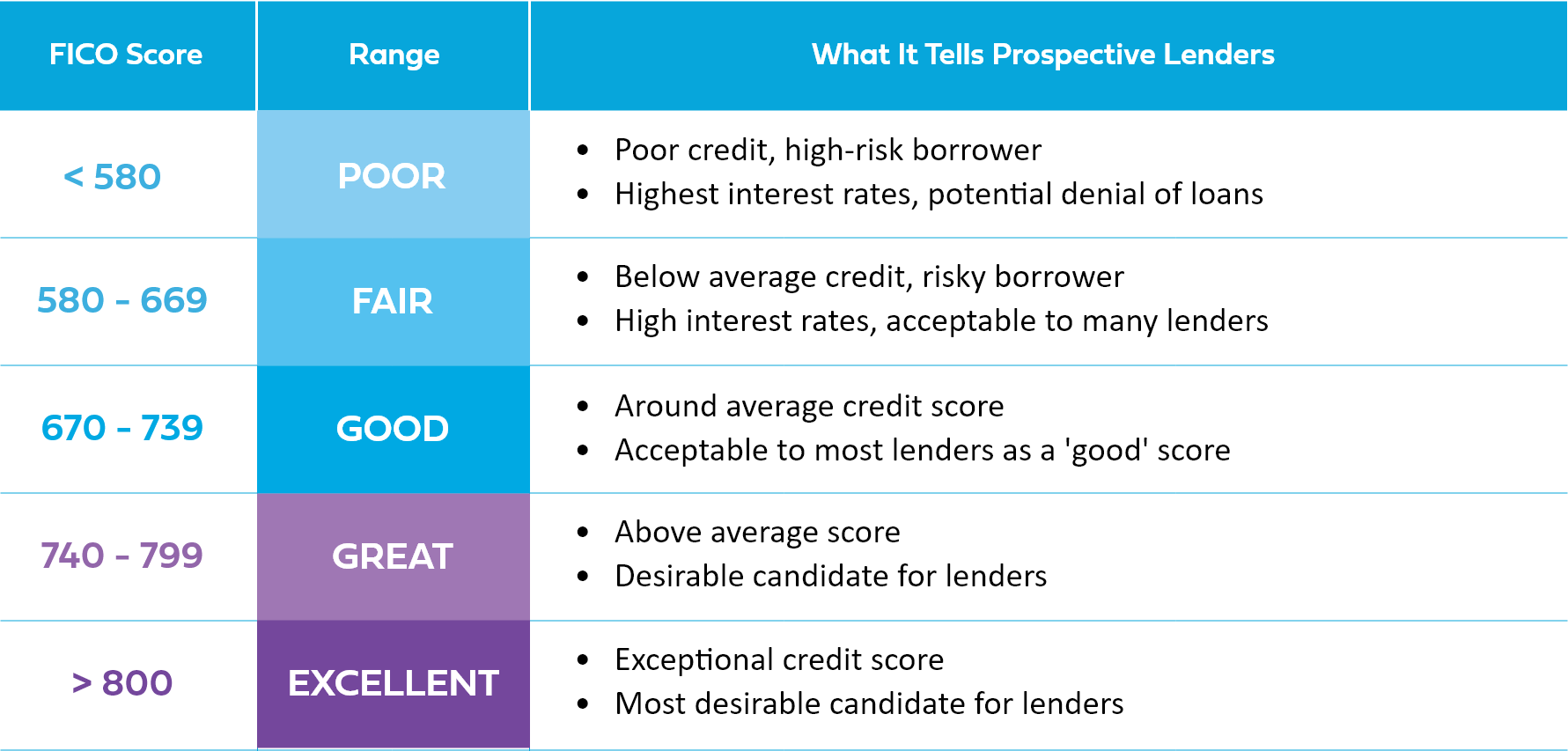

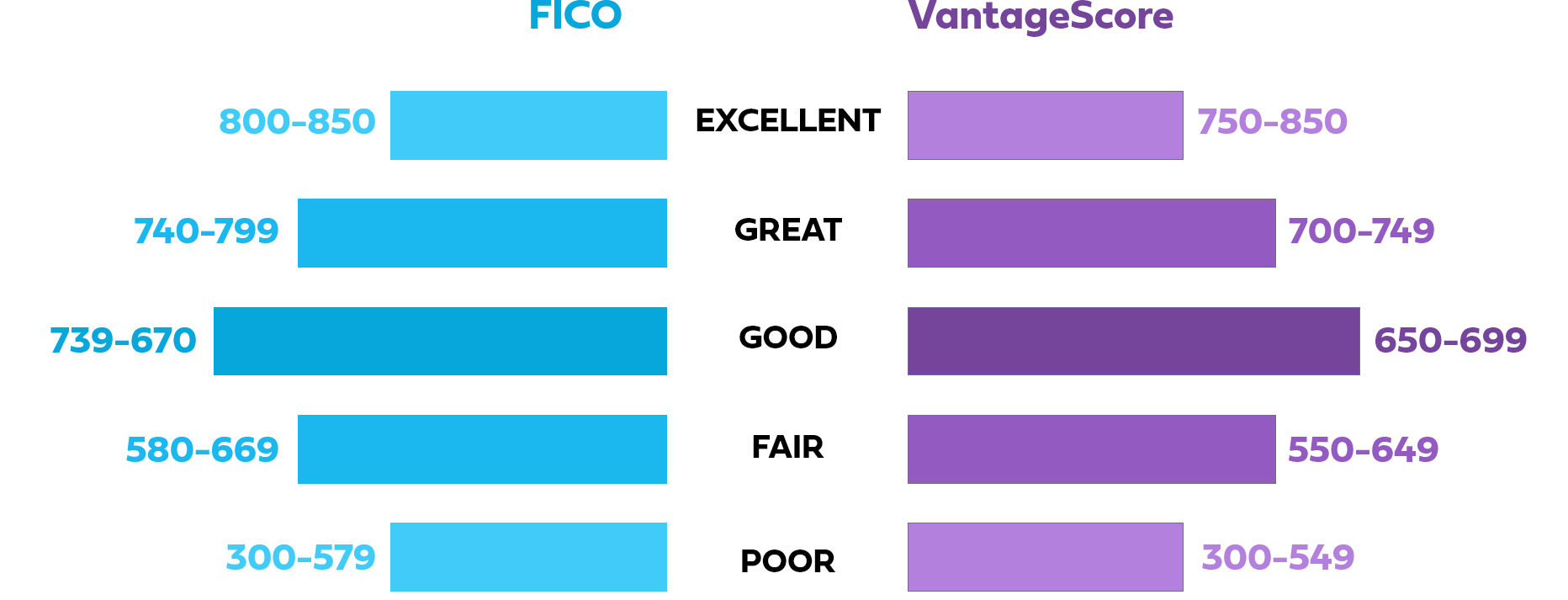

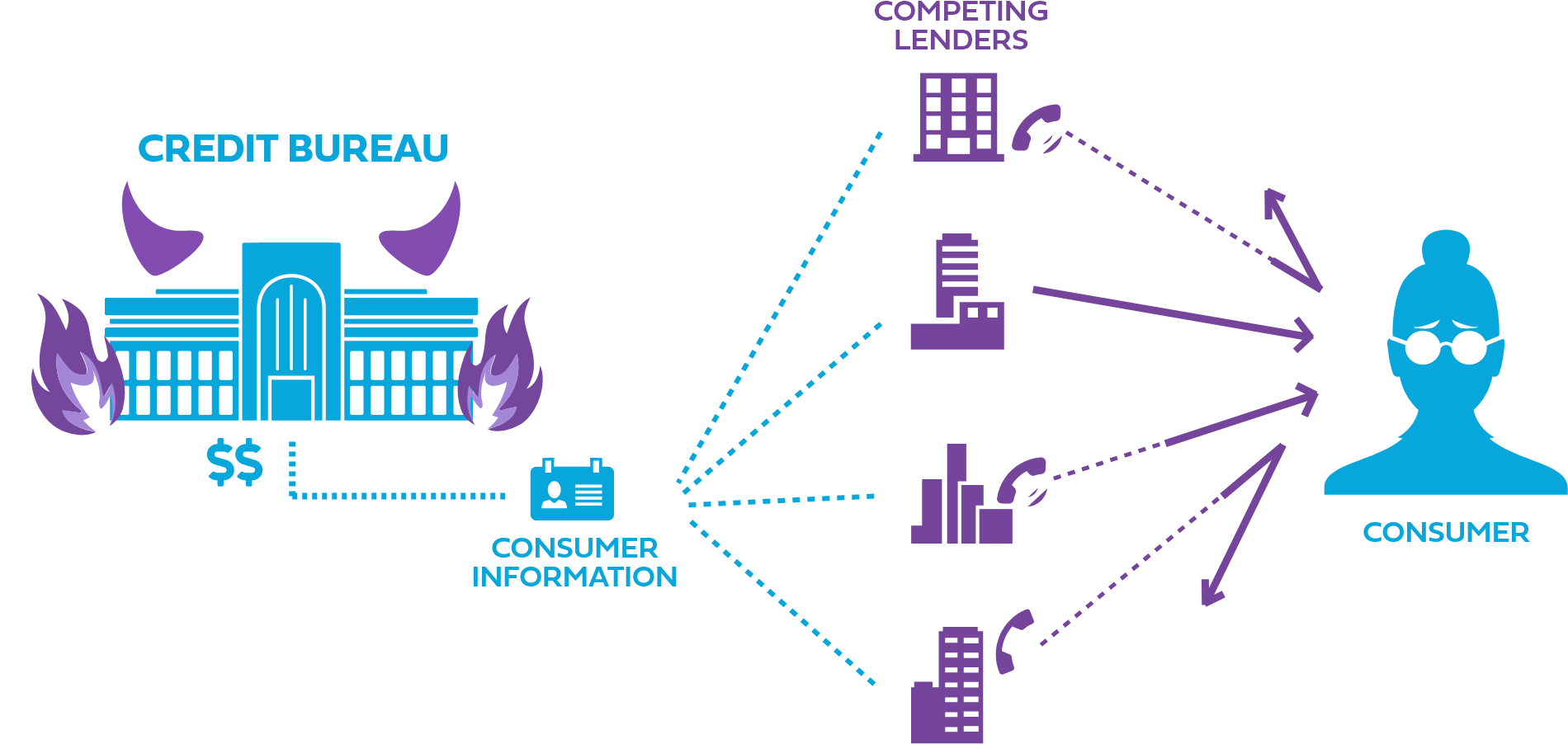

- Not reviewing your credit report prior to applying for a loan: It’s good to know where you stand. The more you know beforehand, the more you can fix.

- Saving too little for a down payment: The higher your down payment, the lower your mortgage payment. But it’s also good to remember, different loan types require different down payment percentages.

- Not researching your loan options: Ensure that you know the different loan options available to you. It is best to understand the loan details before you determine which is the best option for you.

- Foregoing saving for future home repair emergencies: Things happen that you can’t predict—the furnace stops working, the washing machine overflows and many more savings smashing events can and will take place. Be prepared.

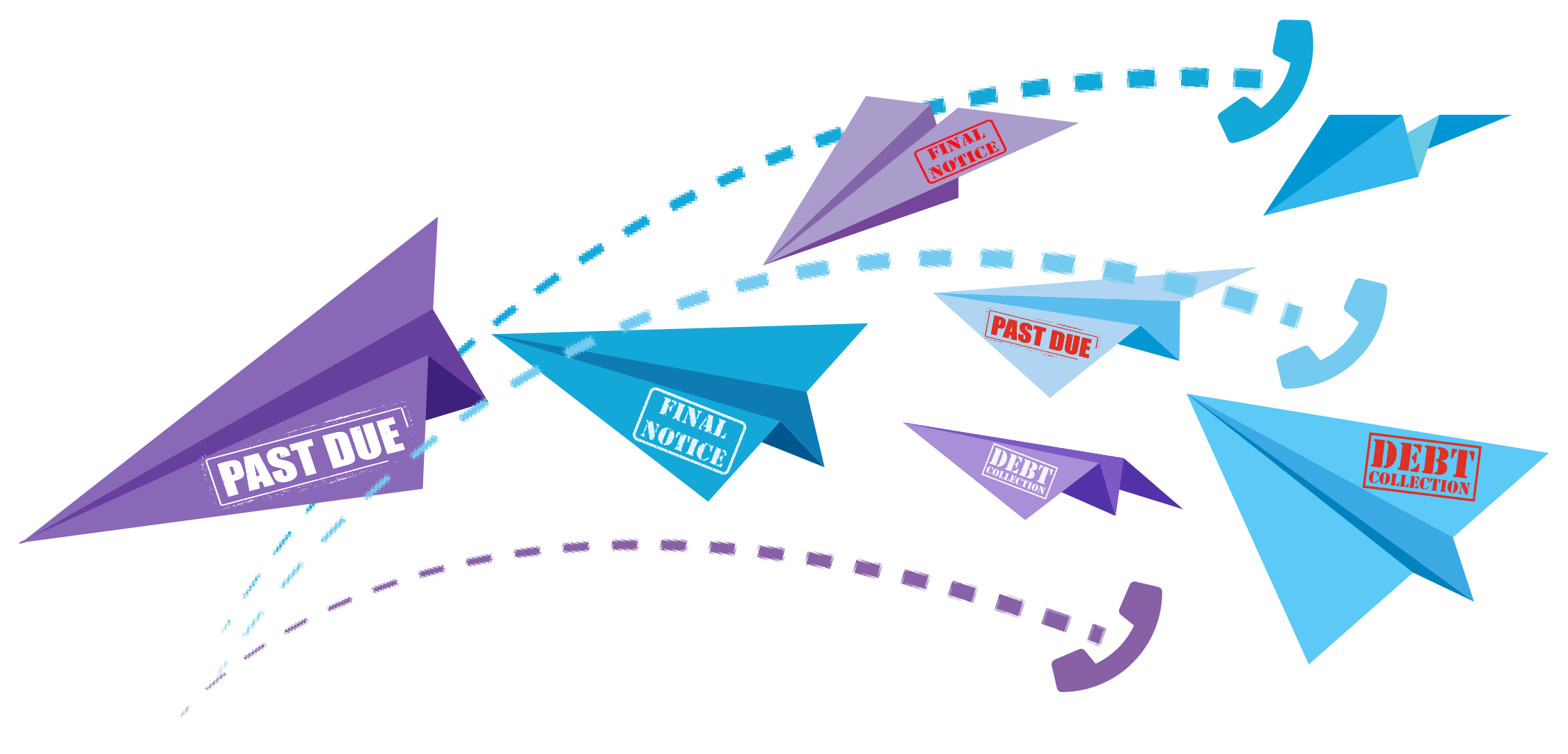

- Applying for credit before you close on your home: Your loan preapproval was based on a specific score and credit report. When you apply for new credit, you will receive a hard inquiry. This type of inquiry will change your credit score and could seriously hinder your loan preapproval.

- Foregoing a home inspection: Home inspections are another expense, one that you should gladly pay. It’s best to find out that your chosen home has a serious foundation problem before you buy it.

- End of Content -

← Previously

Next Up →

Mortgage Essentials

Keep track of your progress and discover content next in line.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

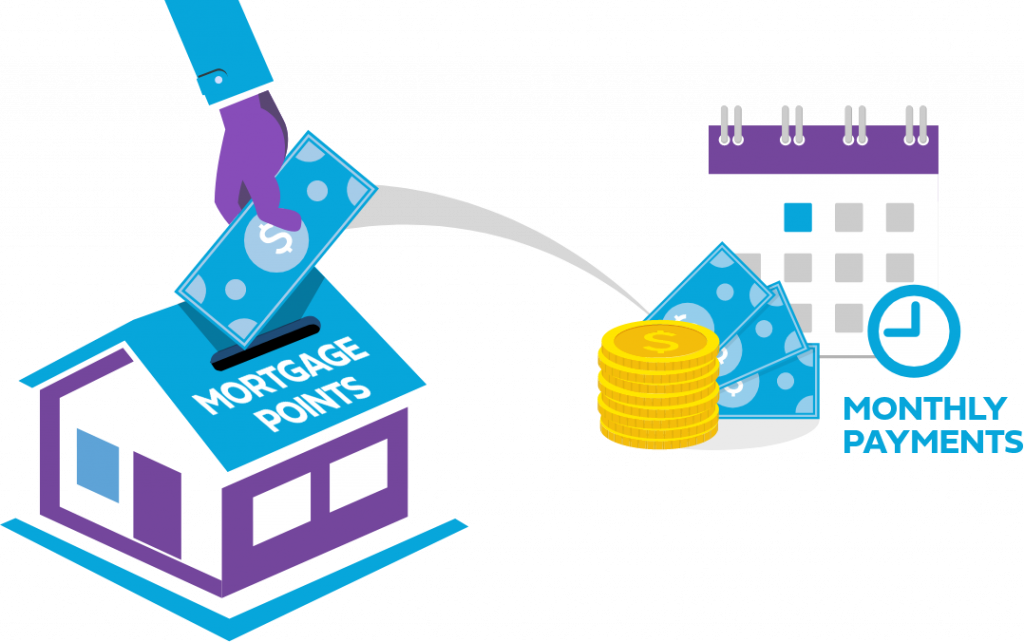

What Are Mortgage Points?

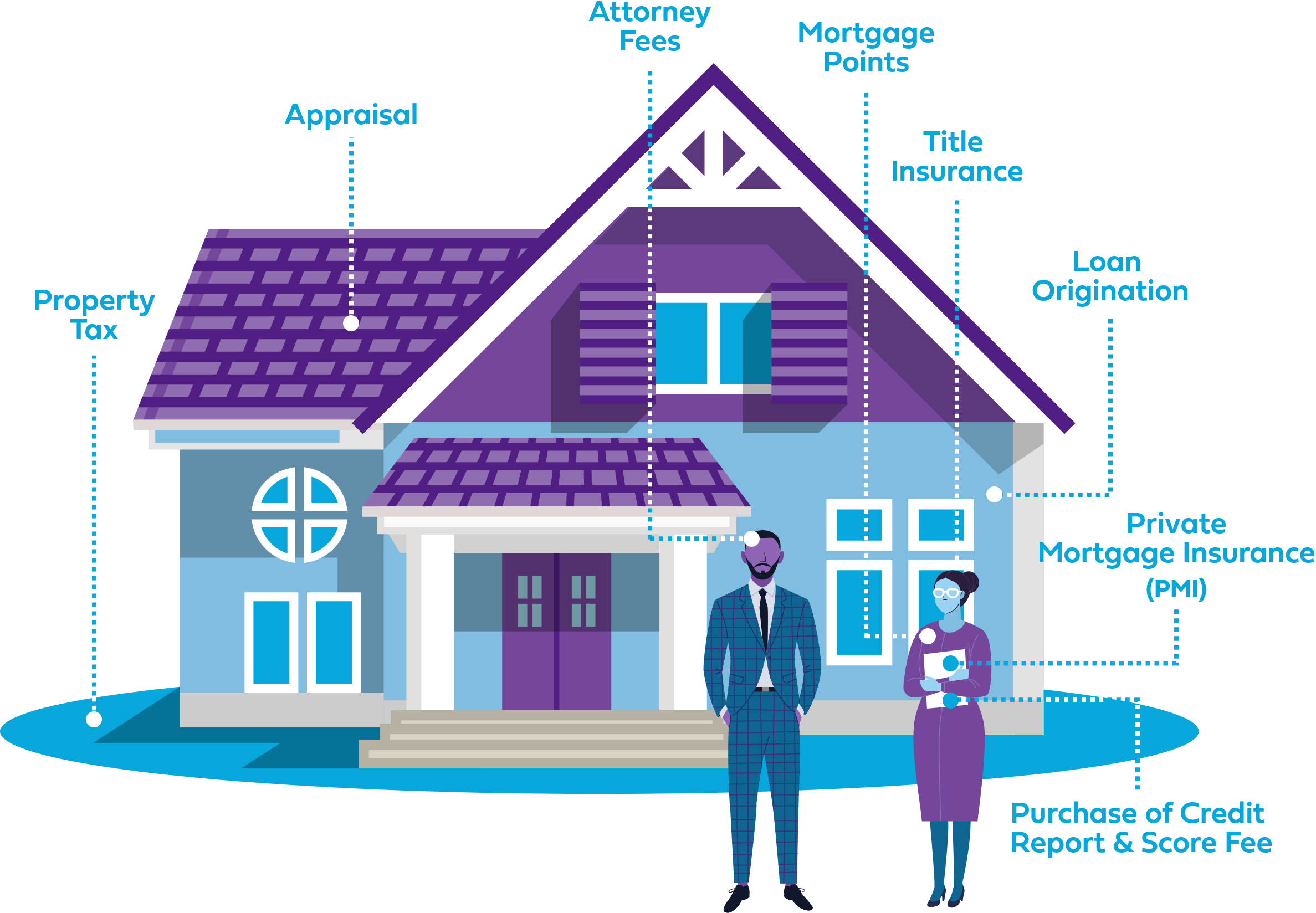

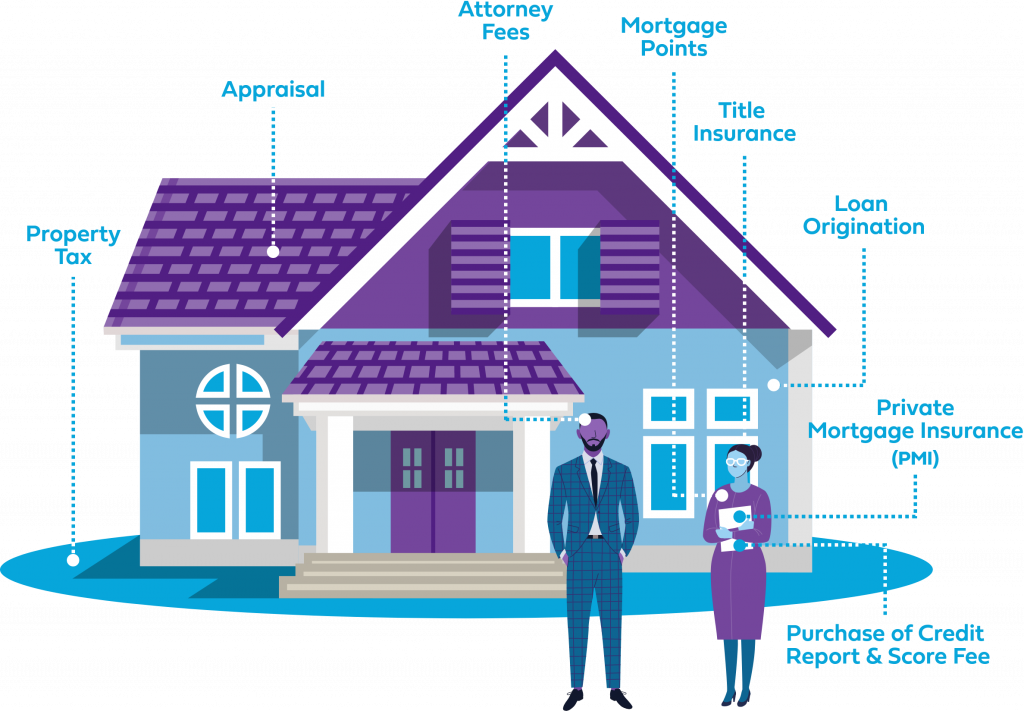

What Costs Are Included in My Mortgage Payment?

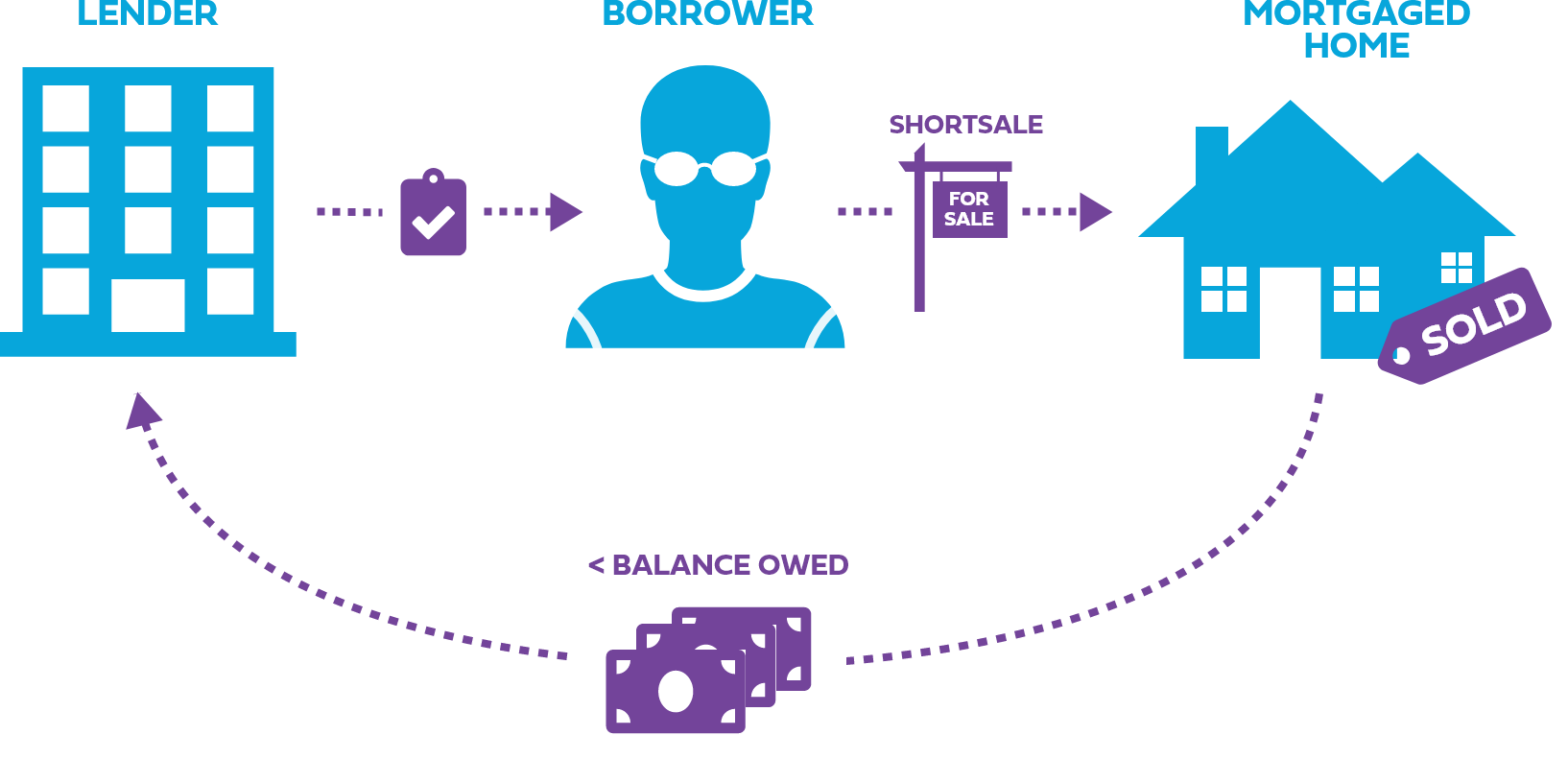

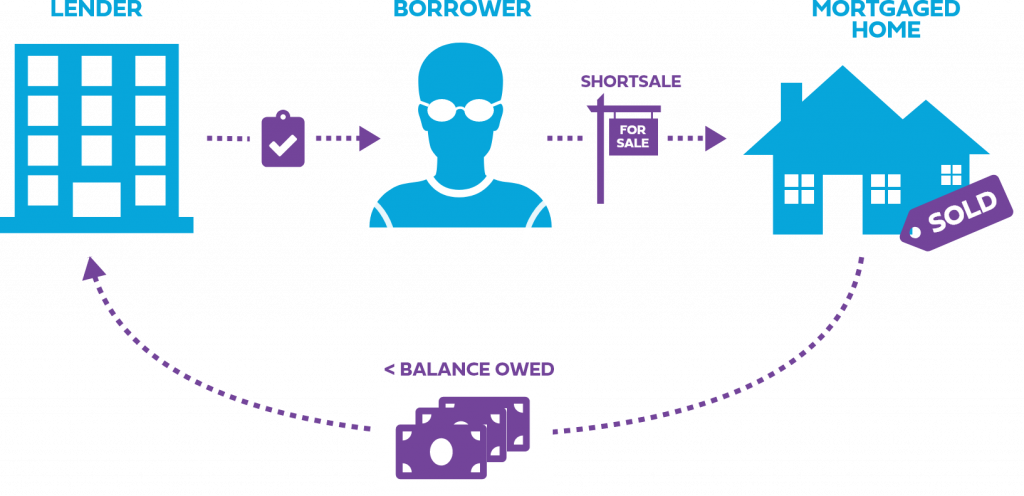

Foreclosures vs. Shortsales

Prequalification vs. Preapproval

Previously

Navigating a Challenging Housing Market

Currently

Common New Home Buyer Mortgage Fails

Learned all of

Mortgage Essentials?

Test your Credit IQ with our short, 9 question quiz.

Learn Your Way Home