Dawn Holmes

NMLS #89242

Residential Mortgage Loan Officer

Learn More about your mortgage professional:

Read More

As an experienced loan officer I have the knowledge and expertise you need to explore the many financing options available. Ensuring that you make the right choice for you and your family is my ultimate goal. To get the process started, use my secure online application or simply give me call for a personalized conversation and apply by phone. As always, you may contact me anytime by phone, text or email for personalized service and expert advice. I look forward to working with you.

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

Dawn Holmes

NMLS #89242

Residential Mortgage Loan Officer

Certifications: n/a

Learn More about your mortgage professional:

Read More

As an experienced loan officer I have the knowledge and expertise you need to explore the many financing options available. Ensuring that you make the right choice for you and your family is my ultimate goal. To get the process started, use my secure online application or simply give me call for a personalized conversation and apply by phone. As always, you may contact me anytime by phone, text or email for personalized service and expert advice. I look forward to working with you.

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

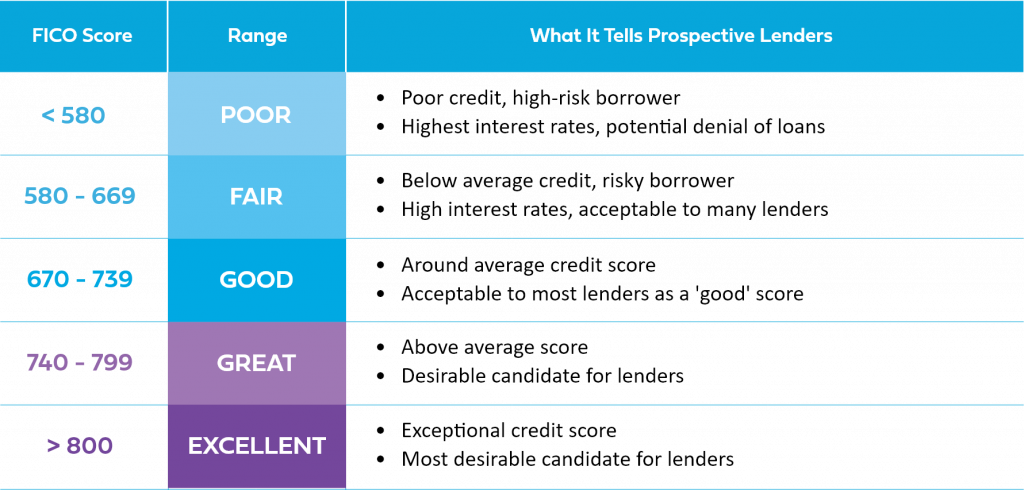

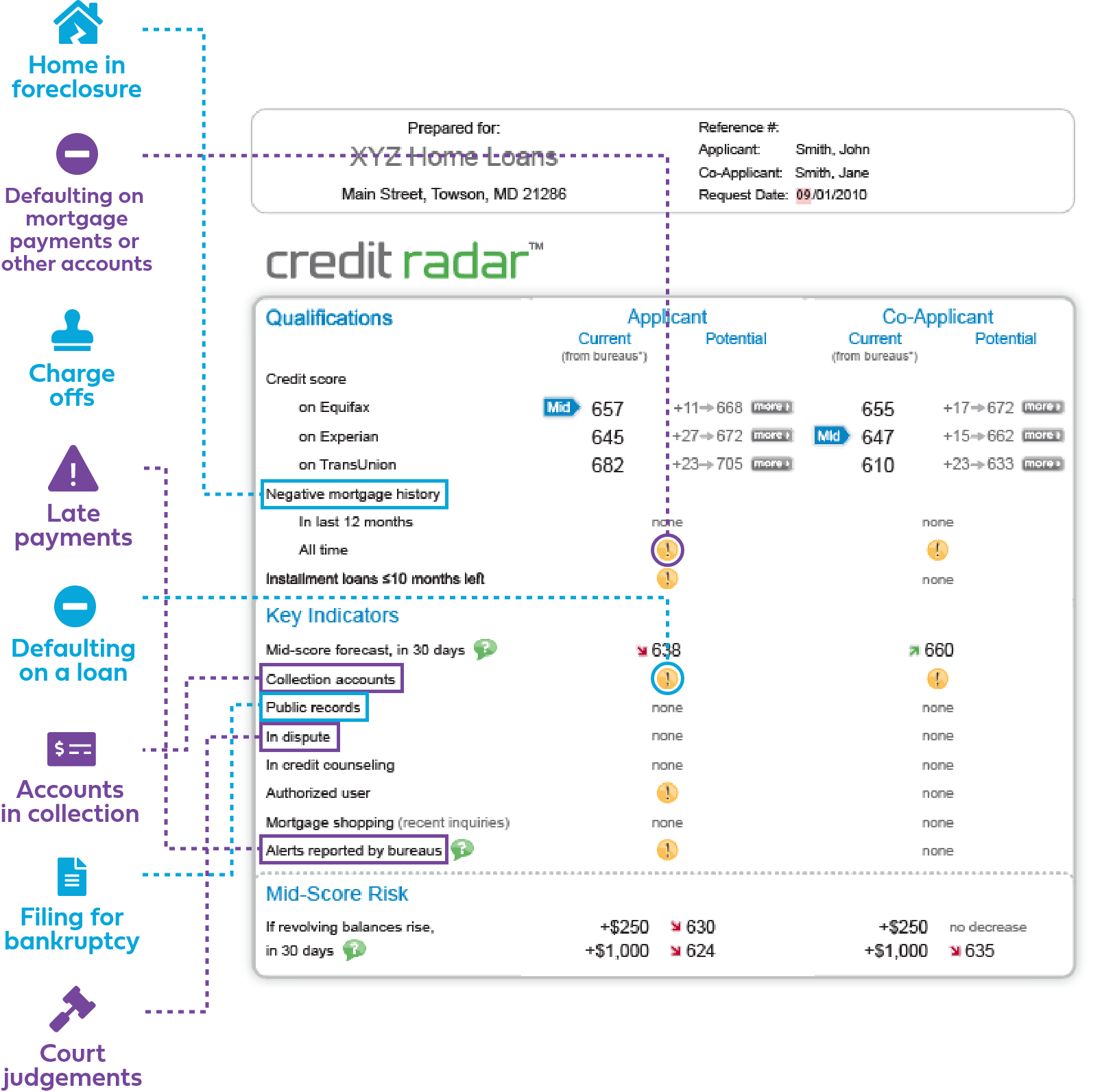

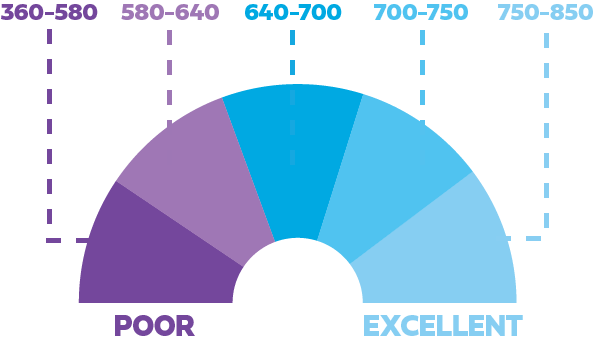

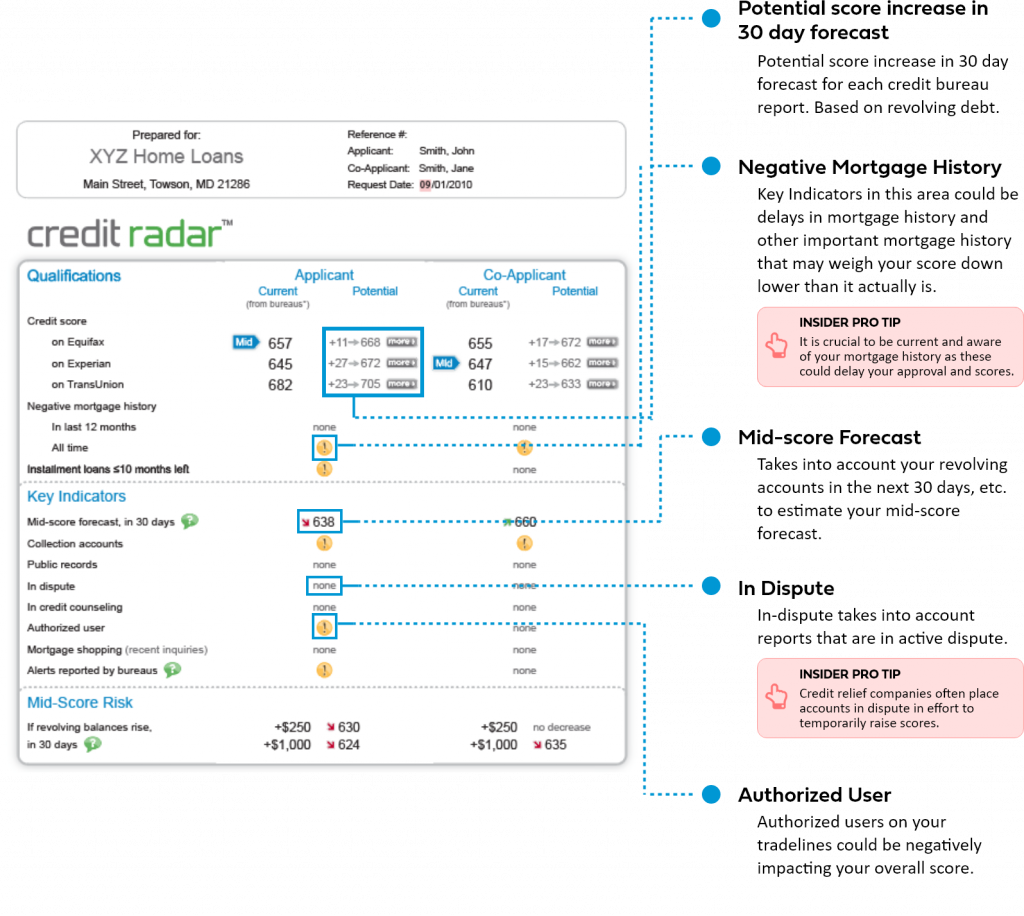

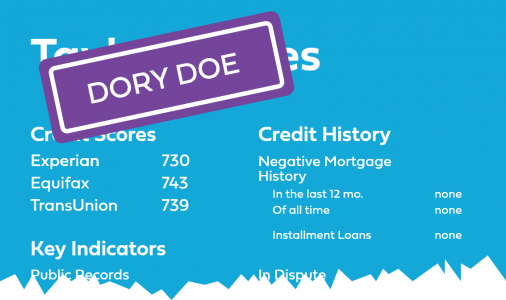

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

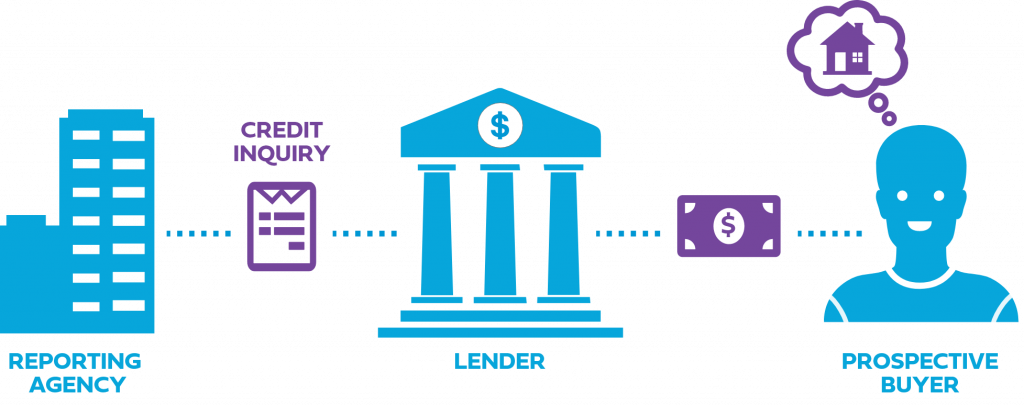

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

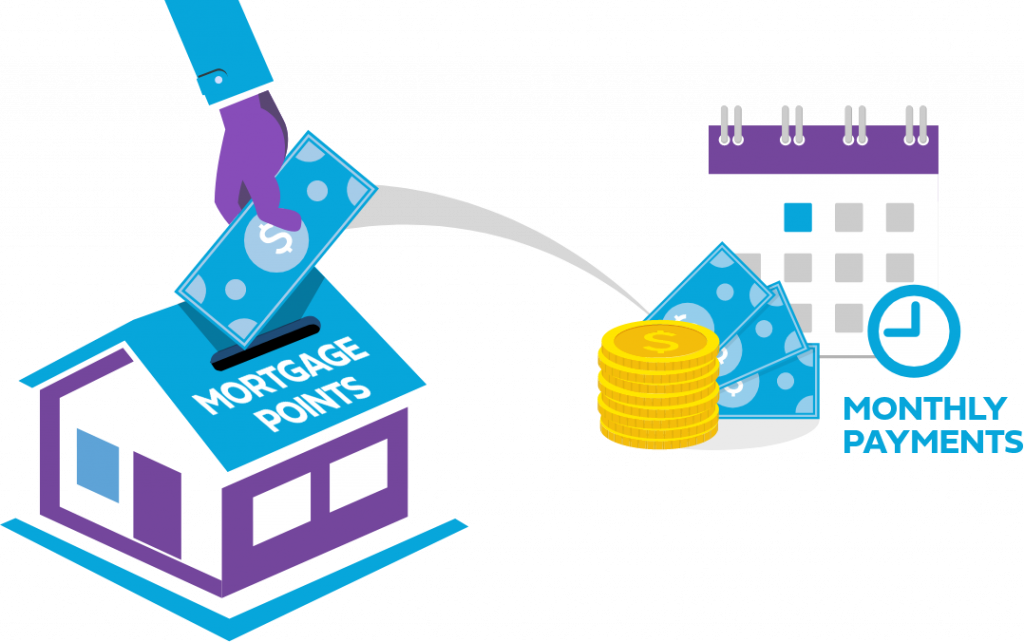

What Are Mortgage Points?

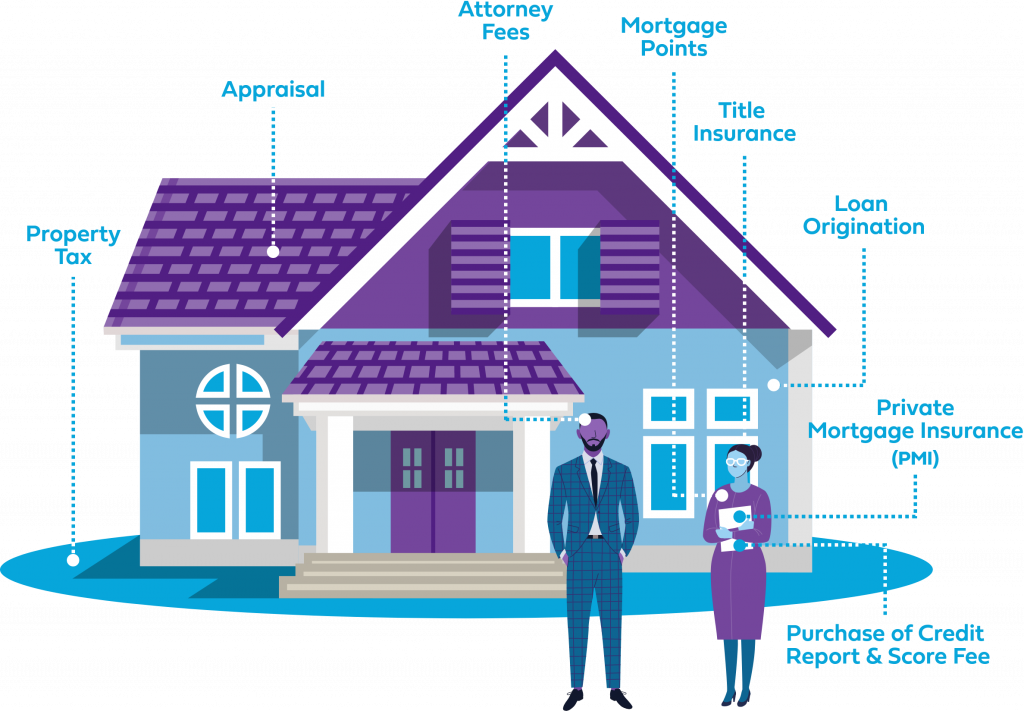

What Costs Are Included in My Mortgage Payment?

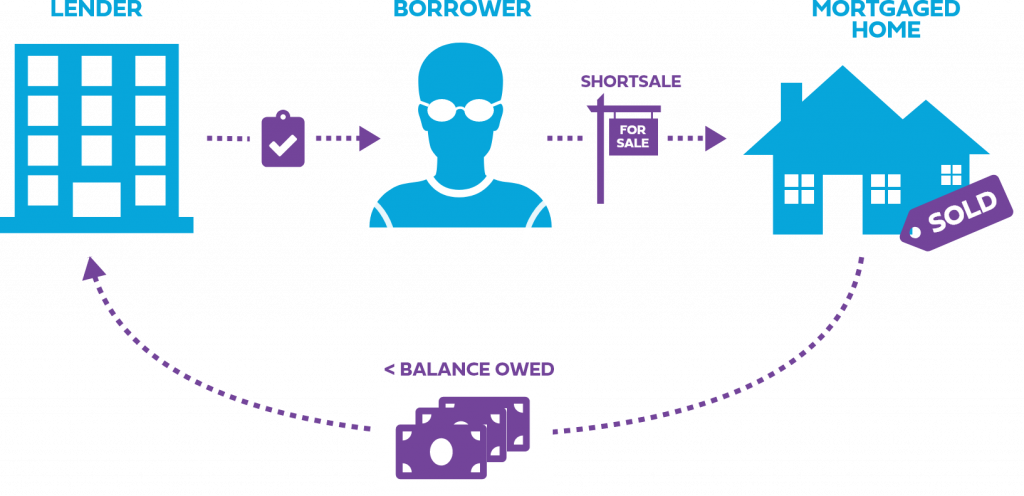

Foreclosures vs. Shortsales

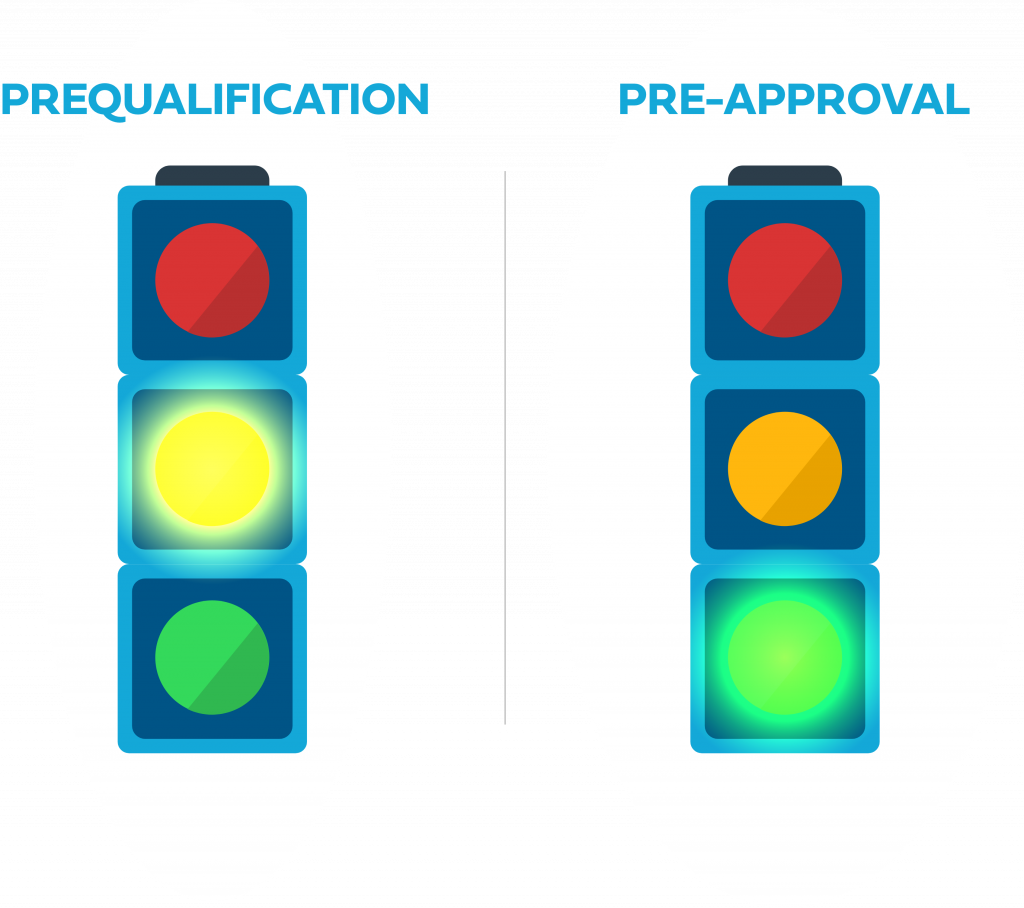

Prequalification vs. Preapproval

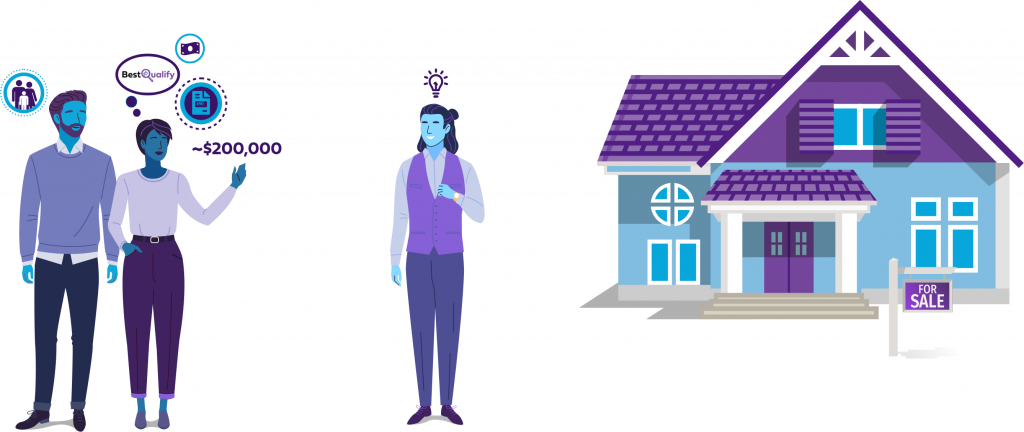

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

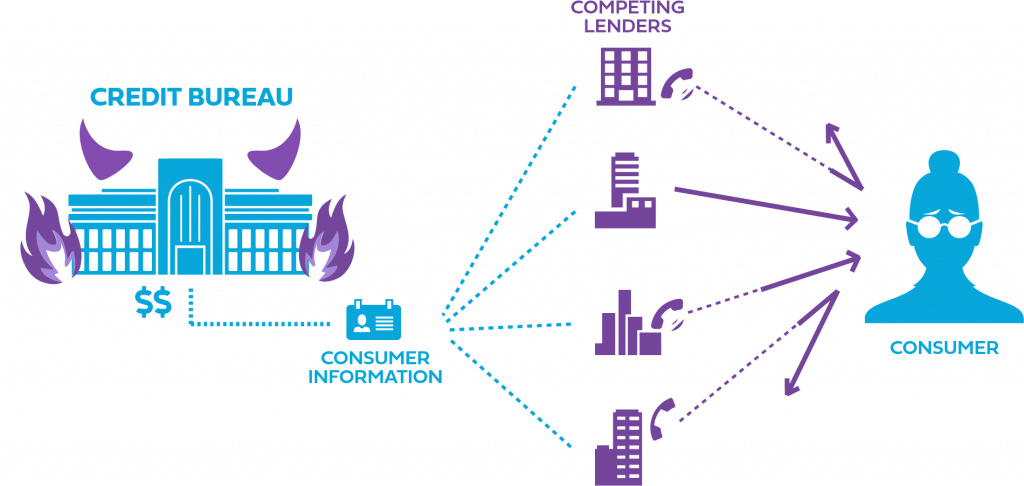

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.