Disreputable Debt Collection Practices

Did you know that the Federal Trade Commission receives more complaints about debt collection companies than any other industry?

There are rules that debt collectors must follow when they reach out to consumers who are unfortunate enough to have a debt in collections. Legitimate debt collectors will work with you and design a repayment plan.

If you are not sure if a collection agency is legitimate, here are some red flags that a questionable debt collector will waive:

- Call you at unreasonable hours (before 8:00 AM and after 9:00 PM)

- Call you at your place of employment even if your company doesn’t allow calls

- Try to collect more money than you owe

- They bully and harass you

- Contact you after you have hired an attorney

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors to participate in deceptive practices like those outlined above. This act pertains specifically to mortgage debt collections. To learn more visit the FTC’s page about this important act.

- End of Content -

← Previously

Next Up →

Buyer Alert

Keep track of your progress and discover content next in line.

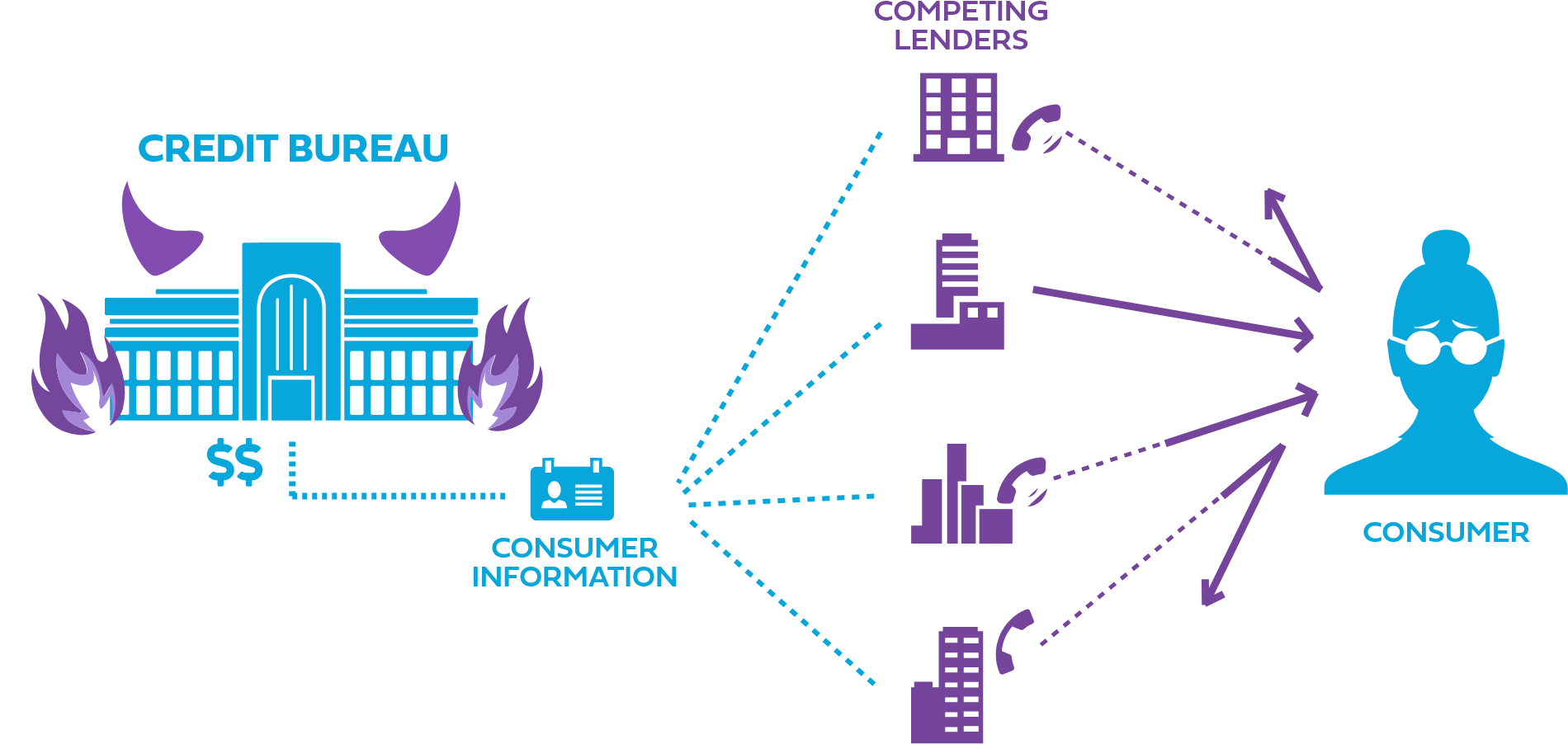

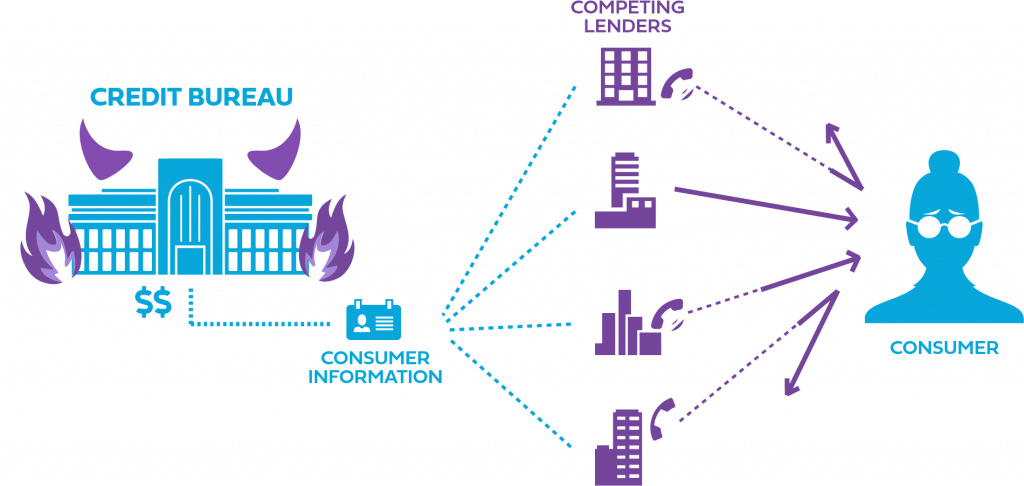

What Is a Trigger Lead?

How Do I Find a Reputable Credit Repair Company?

Mortgage Relief

Previously

Purchasing Tradelines

Currently

Disreputable Debt Collection Practices

Next Up...

Mortgage Fraud: A Warning