Doug Presley

NMLS #1967246

Mortgage Advisor

Learn More about your mortgage professional:

I am a self-sourcing mortgage broker licensed in Texas and Florida. I work for a small mortgage company that has been in business for over 16 years. As a broker, I have relationships with over 15 investors, where I send my loans to. I am involved and understand the whole loan process from beginning to end. From the initial call with the client, to application, to loan origination, to submitting the loan to the investor, to ordering appraisal, insurance, title, to following up with all underwriting conditions, to balancing the closing disclosure, to closing of the loan. That’s the benefit of working for a small brokerage and not a big retail lender. There is no red tape that can get in my way. I have complete control of my destiny.

Read More

Palm Lending, LLC

NMLS #: 164925

- https://www.palmlending.net/

- 13801 Nutty Brown Rd, Austin, TX 78737

Doug Presley

NMLS #1967246

Mortgage Advisor

Certifications: n/a

Learn More about your mortgage professional:

I am a self-sourcing mortgage broker licensed in Texas and Florida. I work for a small mortgage company that has been in business for over 16 years. As a broker, I have relationships with over 15 investors, where I send my loans to. I am involved and understand the whole loan process from beginning to end. From the initial call with the client, to application, to loan origination, to submitting the loan to the investor, to ordering appraisal, insurance, title, to following up with all underwriting conditions, to balancing the closing disclosure, to closing of the loan. That’s the benefit of working for a small brokerage and not a big retail lender. There is no red tape that can get in my way. I have complete control of my destiny.

Read More

Palm Lending, LLC

NMLS #: 164925

- https://www.palmlending.net/

- 13801 Nutty Brown Rd, Austin, TX 78737

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

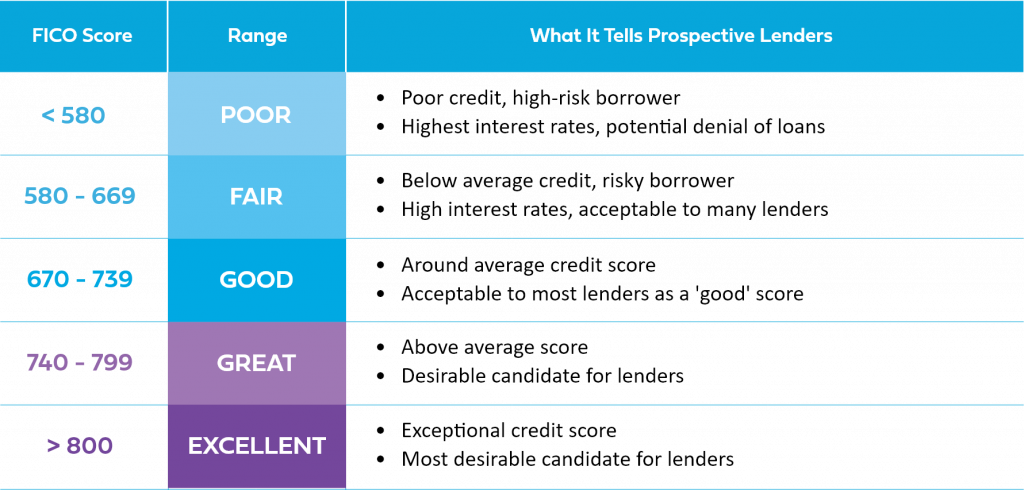

Score & Credit Basics

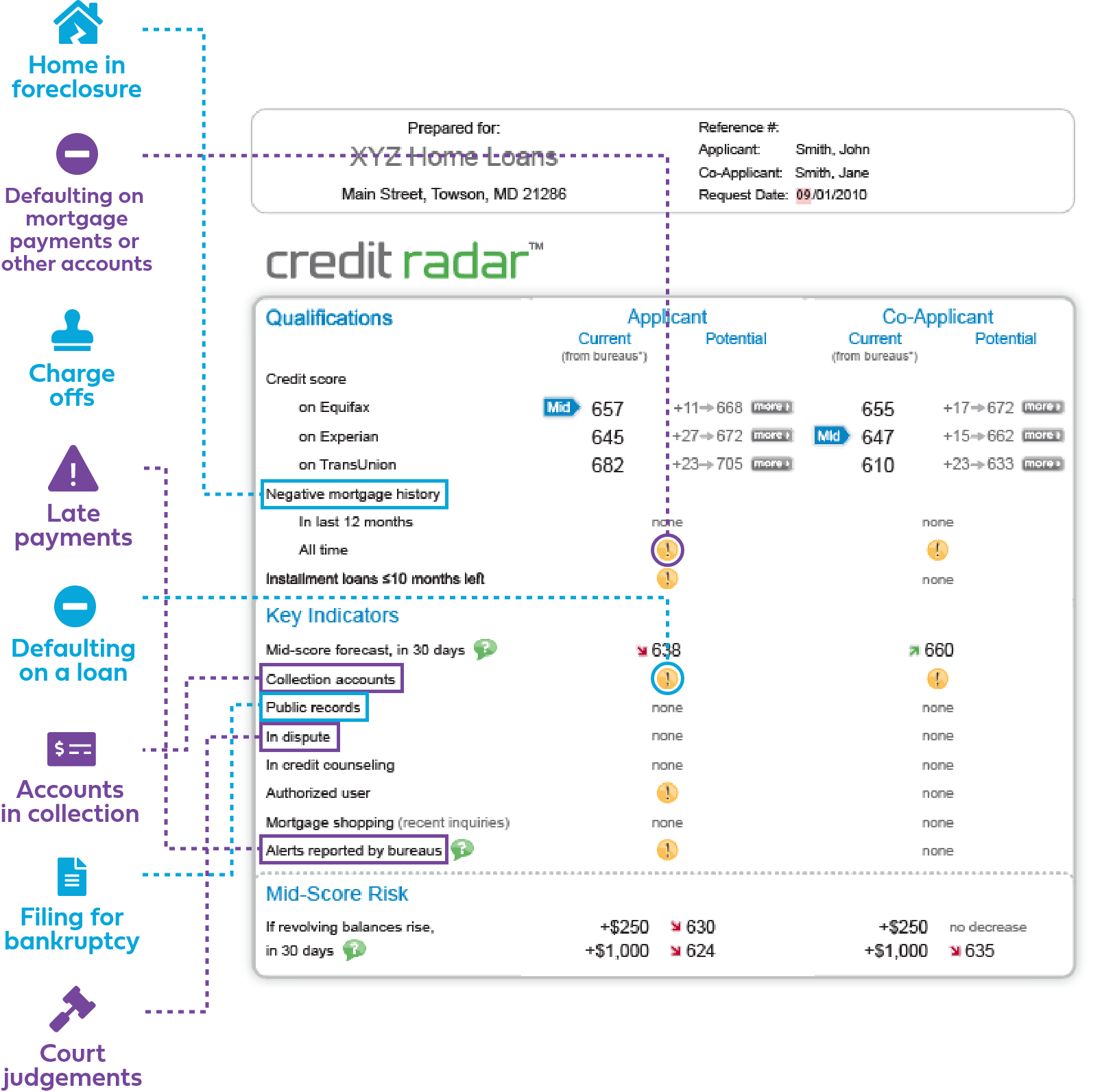

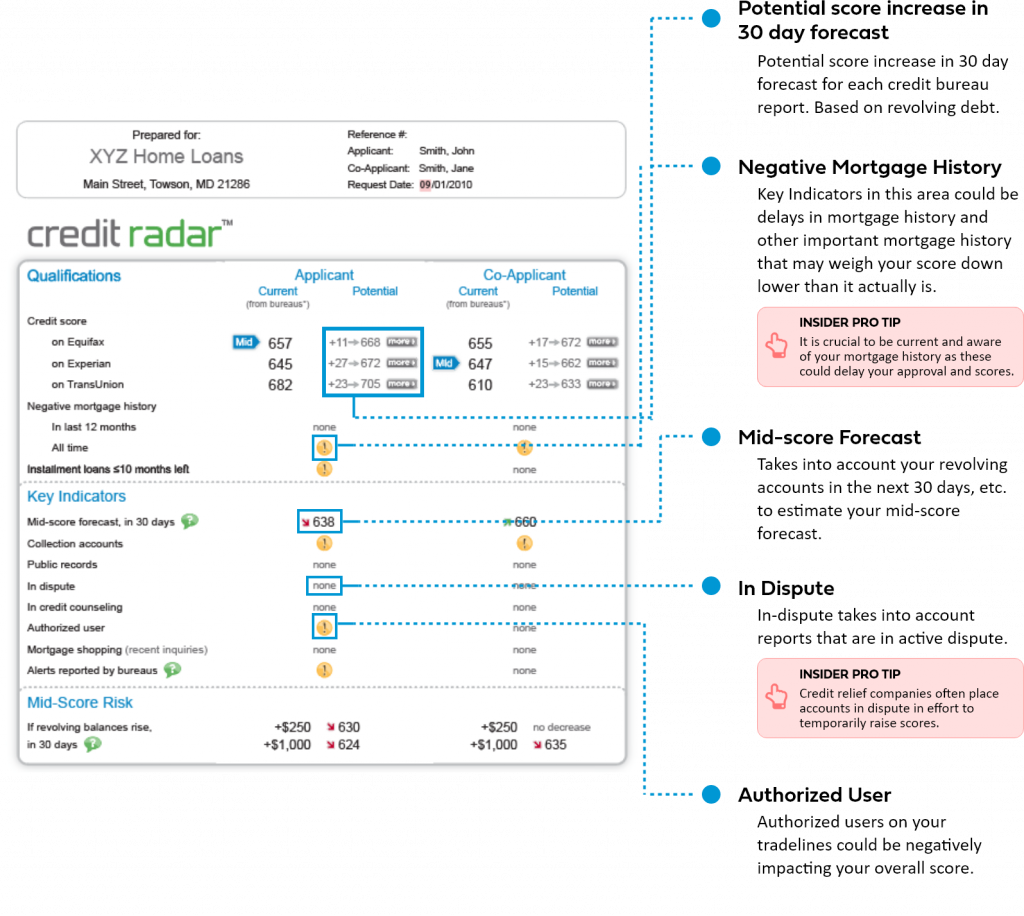

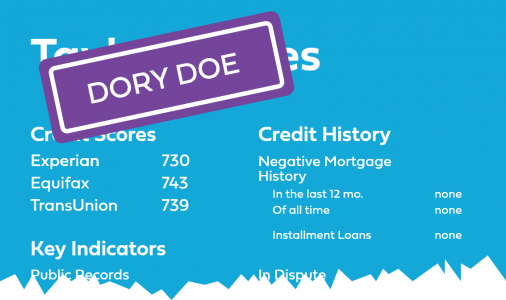

Learn all about credit scores, credit reports, scoring models and more.

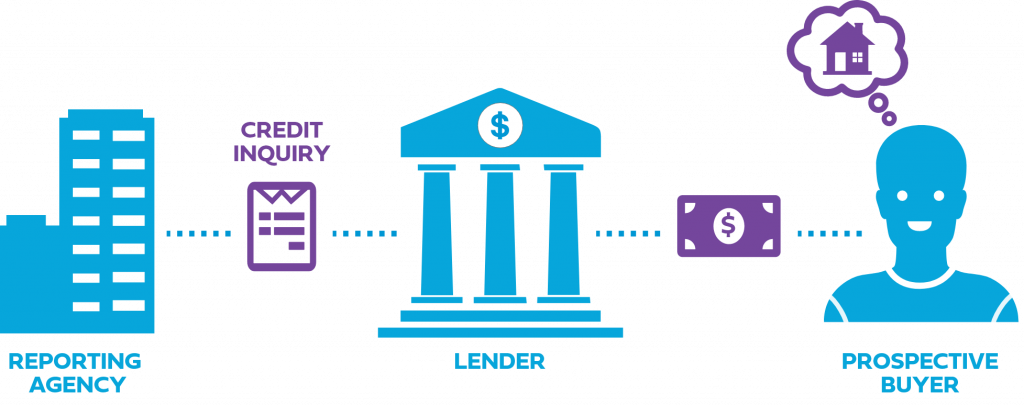

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

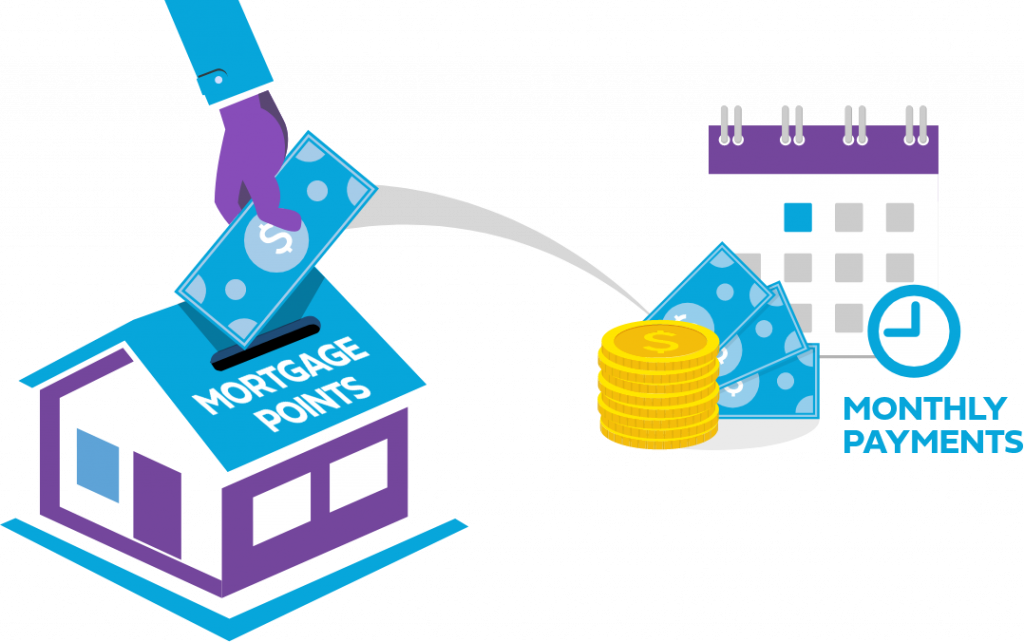

What Are Mortgage Points?

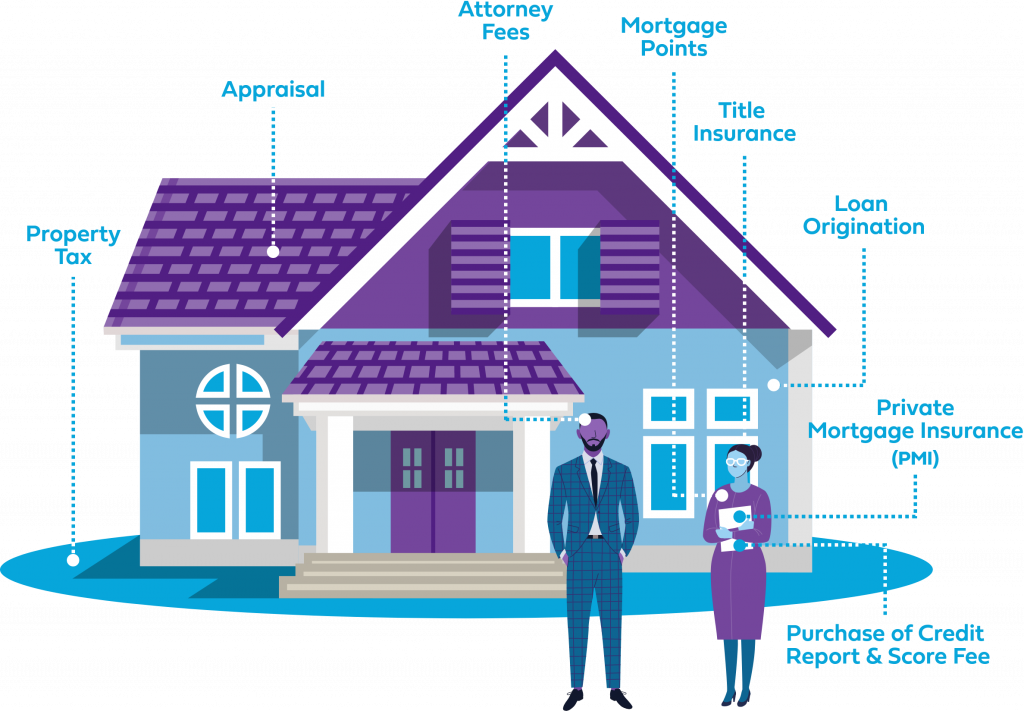

What Costs Are Included in My Mortgage Payment?

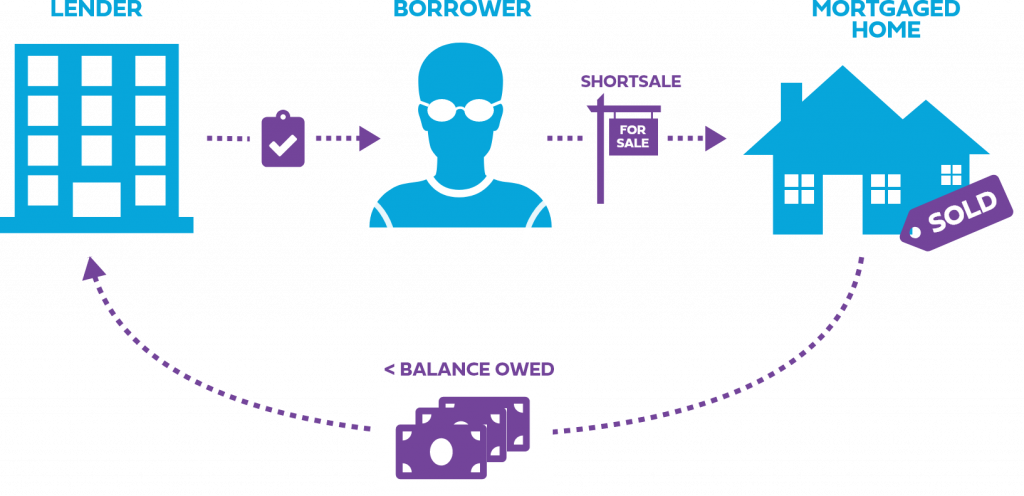

Foreclosures vs. Shortsales

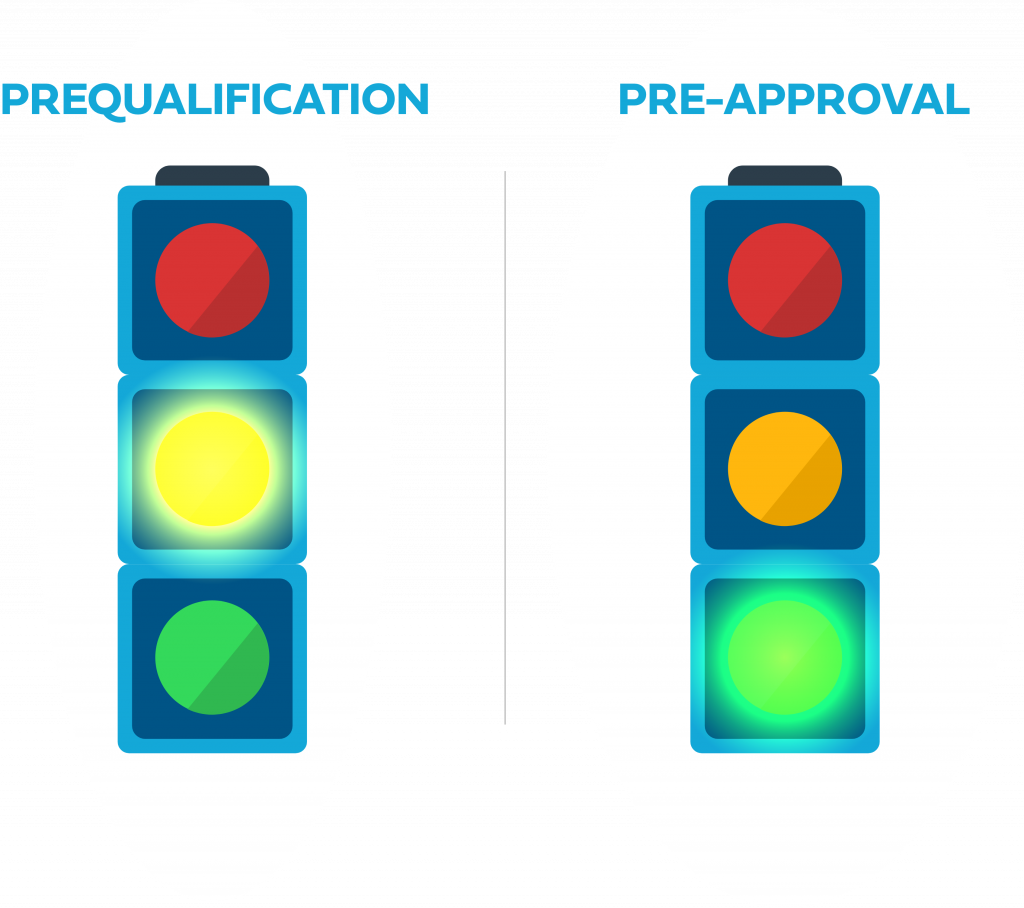

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

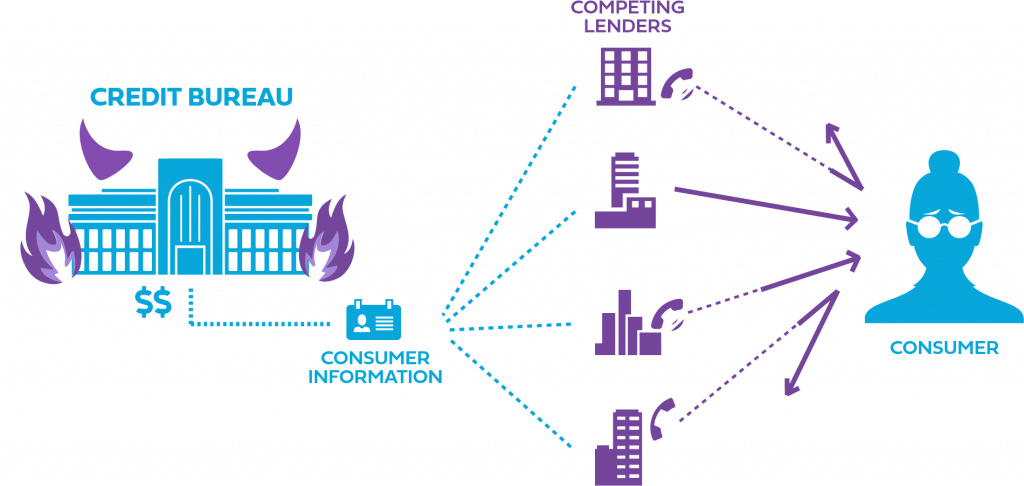

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Are you ready to be a homebuyer?

0%

0%

0%