Steven Lodico

NMLS #239263

Mortgage Loan Originator

Learn More about your mortgage professional:

Whether you’re buying, refinancing, or building your dream home, I am here as your personal Mortgage consultant. Market conditions and mortgage programs change frequently, and I want to give you accurate advice. My expertise and industry knowledge allows me to access many financing options available today.

Read More

I am committed to my customers and want to ensure you make the right choice for you and your family, with service that exceeds expectations being my ultimate goal.

Palm Lending, LLC

NMLS #: 164925

- https://www.palmlending.net/

- 13801 Nutty Brown Rd, Austin, TX 78737

Steven Lodico

NMLS #239263

Mortgage Loan Originator

Certifications: n/a

Learn More about your mortgage professional:

Whether you’re buying, refinancing, or building your dream home, I am here as your personal Mortgage consultant. Market conditions and mortgage programs change frequently, and I want to give you accurate advice. My expertise and industry knowledge allows me to access many financing options available today.

Read More

I am committed to my customers and want to ensure you make the right choice for you and your family, with service that exceeds expectations being my ultimate goal.

Palm Lending, LLC

NMLS #: 164925

- https://www.palmlending.net/

- 13801 Nutty Brown Rd, Austin, TX 78737

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

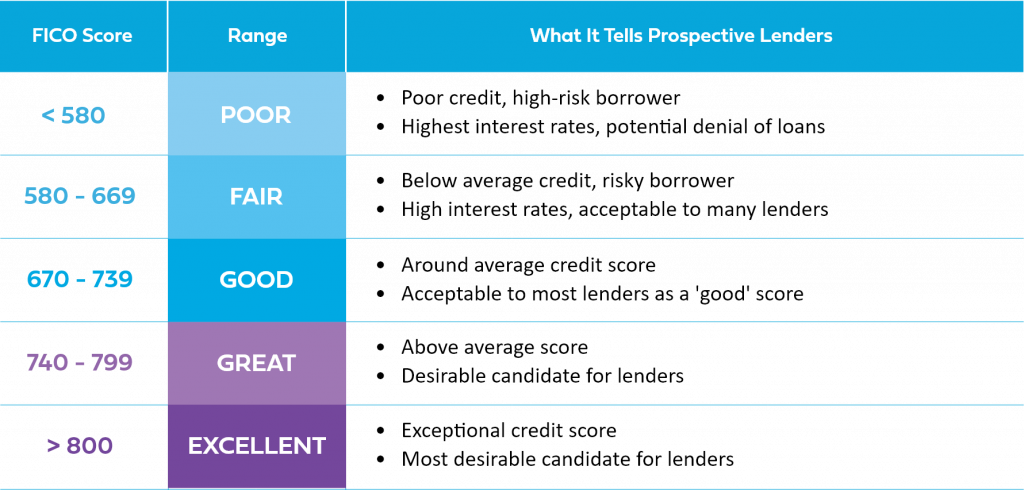

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

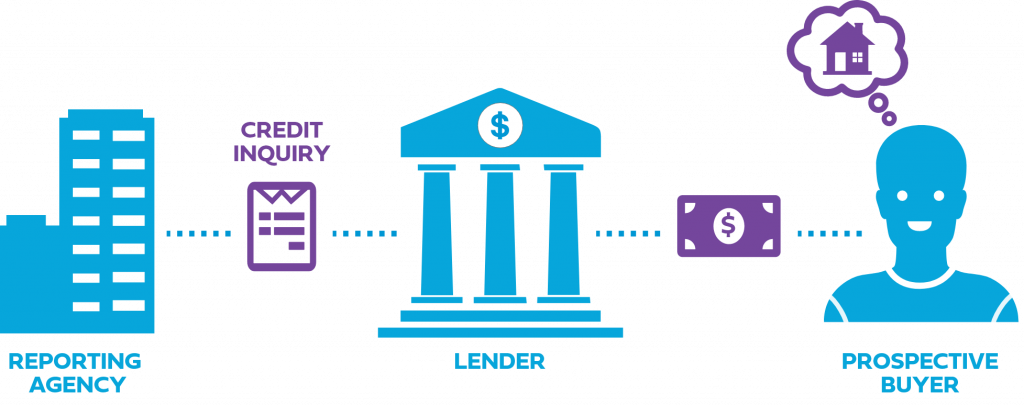

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

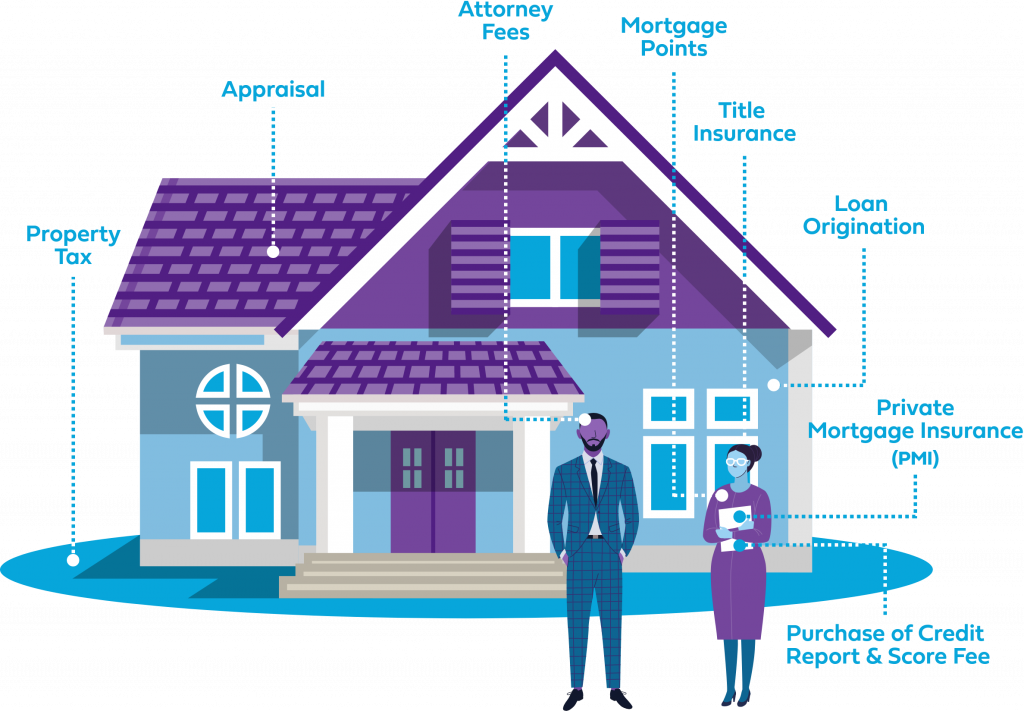

How Much Should I Save for a Down Payment & Closing...

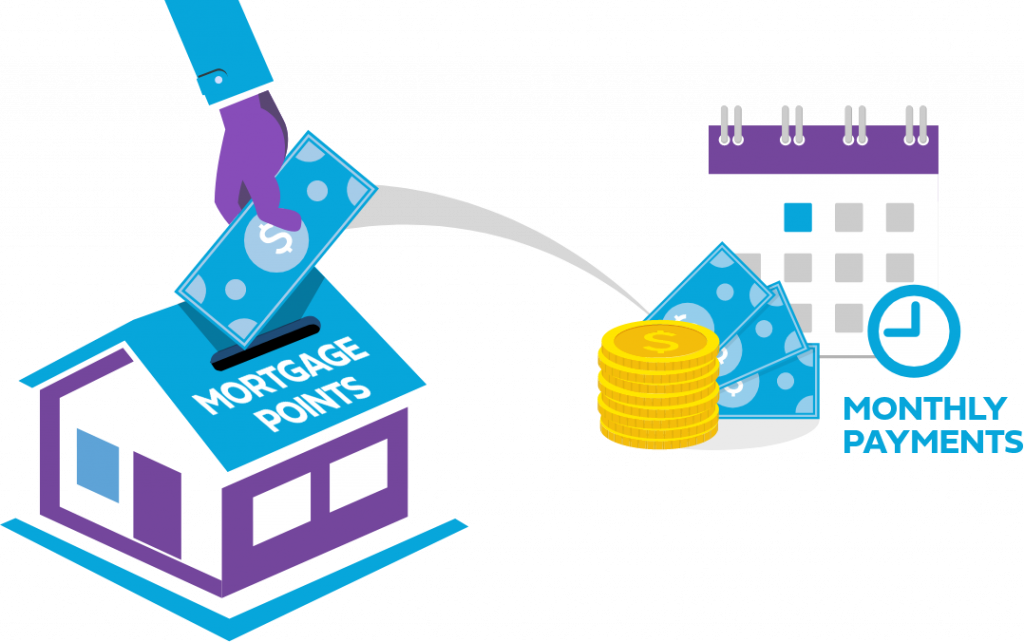

What Are Mortgage Points?

What Costs Are Included in My Mortgage Payment?

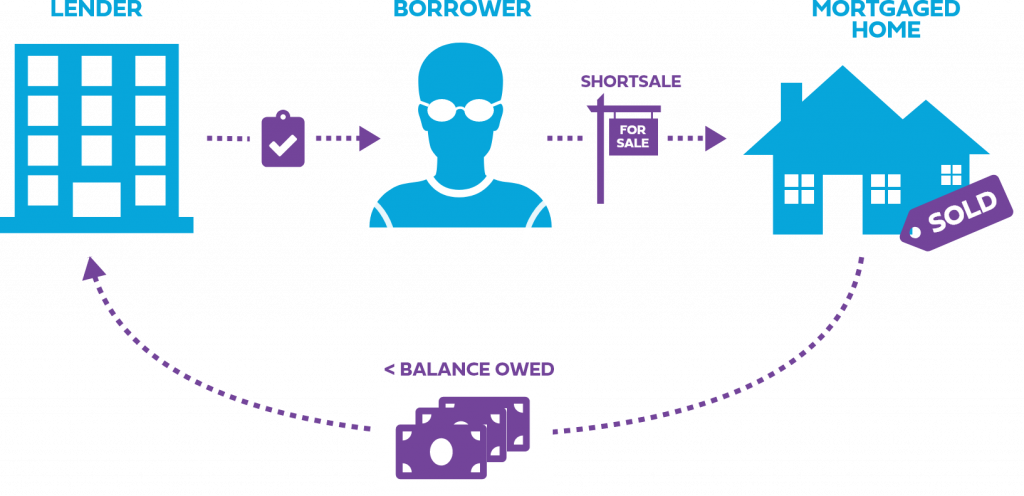

Foreclosures vs. Shortsales

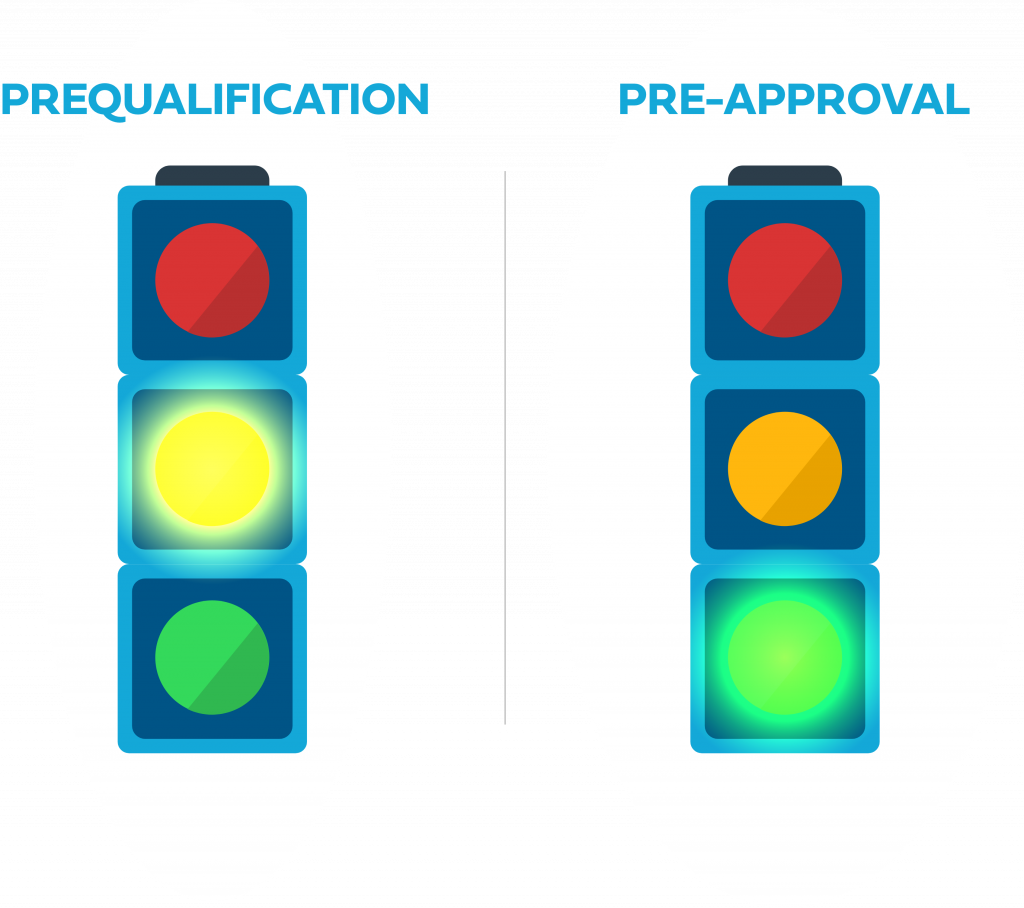

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

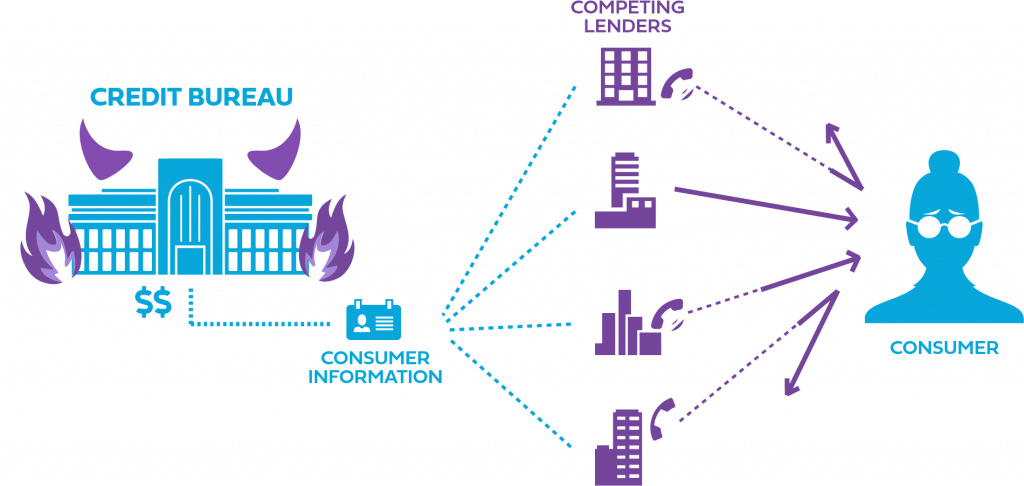

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Are you ready to be a homebuyer?

0%

0%

0%